Friday, November 03, 2006

Pizza Party

I never saw the sudden drop in stocks that I was waiting for in October. However, it seems that things are starting to stall as we approach the election next week. I'm sure there's a pattern usually seen after off-Presidential elections, but I'm not going to play that game this time. I'm starting to like news-less research all over again!

Besides, the blogs are where it's at! Mainstream media is best for the herds (but there is BIG money in it)!

Sunday, October 29, 2006

Taking it in the Shorts

Meanwhile, my virtual stock game at VSE is showing my getting ripped a new one from betting agains Google. All I can say for myself is, "ow." I'm keeping the short for now because I'm getting some change back that I lost.

Now I know why some money managers NEVER attempt to short. Not a good idea when the Dow is breaking new highs and the other indices are tagging along!

Cheers! And here's to more posts to come soon!

Friday, September 15, 2006

A Lot of Loud Silence

Perhaps when the reality of housing hits, ARMs convert, foreclosures go up, cats & dogs start living together, we'll see renewed interest in stocks? Or more running for cover?

Speaking of housing, there's this great comment I read off of my favorite (other) blog, The Big Picture:

"...To complete the global picture, consider this - in one of the condo buildings I surveyed in Pune (near Bombay), the builder told me that 50% of the condos were sold to US investors who used, wait for it, HELOCs in their US properties to buy property in India."

And I thought the lottery was the only tax on stupidity!

Thursday, September 14, 2006

Bond-O

Some say that the bond market contains the 'adults' of the markets, and bond prices are rising. Isn't that a sign that we might be in for some more bad days in stocks? There are all the reasons, FED Watch, Oil prices, housing, etc.. but the fact remains that bonds are rising.

Even this morning, the local Orlando news had a story of realtors admitting that the soft landing is going to be harder than previously thought. They expect the slump in sales to bottom next summer. But they were wrong about the landing (or just didn't want to admit it), so I take their word with a pinch of salt.

Wednesday, September 13, 2006

Been Off Track

This has cost me in my trading as well as my blogging. I've been hammered the past few days, losing gains while not keeping on top of them. Tonight I begin to scan the indices, news, and other blogs that I watch for updates and find out what I've missed. Gold has fallen, oil is down, and the markets have been rallying in concert.

It's been 3 days now for the Nasdaq to rally, and it's showing signs of weekness. Since I've been hurt shorting so many times, I hesitate to short now. I was hoping to become more bullish, probably because of this uptrend that we've been in for a few weeks now. Meanwhile, the prophecies of another major correction in October still linger, with a few mentioning it. Now WOULD be a good time for another correction, because no one expects it.

There are several reasons that things are up this week, Options expiring Friday, oil down, consumer confidence rising, VIX down, optimistic FED expectations, and the smart money is pounding the Bears. I expect to see some profit-taking on Friday as the rest of us newbies decide to go long.

As for myself, I'm going take a good, long look at the big picture before I jump back in.

Wednesday, September 06, 2006

Long Weekend

It's good to see an up-day, but I feel that the recent end-of-summer rally is a bit overbought. In particular, I noticed Ford's chart was showing a weeker slope with possible signs of a turnaround. I shorted yesterday, right before Bill's announcement of his new CEO. The stock is up on the overnight news, but I'm not ready to give up yet. The stop is set, and I expect the price to recover down to the low of a channel, maybe to 7.80, before recovery.

Basically, the good news had already been 'baked in' to Ford's stock. I wanted to go long when I first heard Ford had hired a well-known turnaround manager, but the stock had already rallied. But I watched it rise another 2 bucks while waiting for the rocket fuel to burn out. I don't expect to be short more than a week, as I have good faith in the new CEO. However, it will be a long and slow recovery.

Here's a random question:

Why is it that the really cool/funny commercials these days are by the credit card companies? Namely, the Capital One commercials, and the Citi Identity Theft victims are my favorites today. Until about 5 years ago, the beer commercials were the best. What happened? Did those talented marketers move to companies that serve the credit card companies? Or is this a sign of the times, that money is no longer in beer, but in the financial industry?

Tuesday, August 29, 2006

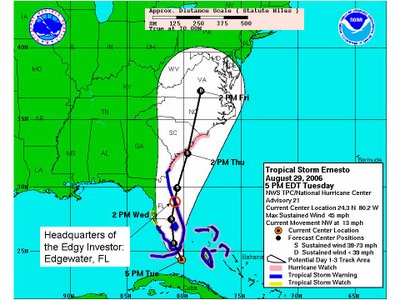

It's KATRINA all over again!!! Shut down the State of Florida!!!!

I shouldn't be too surprised at this irrational exuberance, given today is around the anniversary of Katrina in New Orleans, 500 miles away. I can understand the officials being 'better safe than sorry', but hurricanes and tropical storms lose strength over land. Ernesto will hit Miami rather hard, but not at hurricane strength. It will cruise its way up through the middle of Florida, losing strength the whole time.

I say Orlando and Daytona are over-reacting, closing schools so that the school buses don't have to drive in 'high winds'. We will get rain up here, lots of it dumped down, but not the high winds.

I'll be home with the kids, checking the markets and reading books. Cheers!

Sunday, August 27, 2006

Running Scared

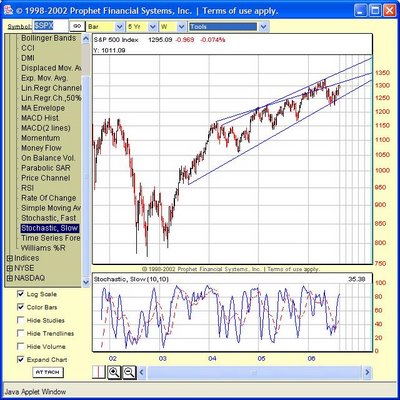

Now, from my limited experience, I've seen breakouts from triangle patterns usually happen before the point is reached. I pulled up a chart of the S&P 500 to get a guess of where it might be in Q1-Q2 of 2007. It's currently riding a channel up, and could be anywhere between 1300 and 1380 if it stays in that channel.

That diagonal line cutting the channel was where I noticed some consolidation on the resistance side. The line follows the upper level from March of 2004 through today, with the exception of the breakout and resistance from Nov 2004 through May 2005. I left that in to note some interesting behavior how that line seems relevant. But this it technical analysis, so it might not mean anything beyond this point. The Stochastics show signs of peaking already, but the momentum and RSI still have room to grow (not shown).

I'm concerned about the weakening Stochastics. I'm dropping my shorts (pun intended) and starting to find myself in more long positions. But I'm afraid this may be too much of running with the Bulls, and the Bears will sneak out from the trees and take us by surprise.

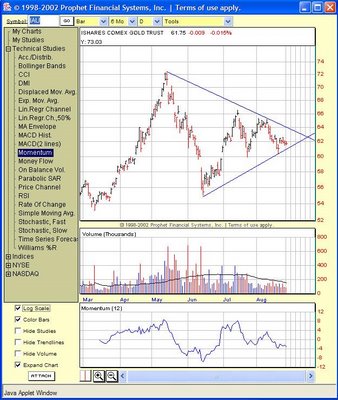

The XAU is nearing resistance, and gold itself is showing weakness at the end of its own symmetrical triangle.

Hmmm....

Monday, August 21, 2006

Just When I Thought Gas was Getting Better

"VIENNA, Austria (AP) -- Oil prices rose back near $72 a barrel Monday, rebounding from declines the week before, after Iran insisted that it will not suspend uranium enrichment.

Prices also appeared underpinned by concerns about supply disruptions in Nigeria due to civil unrest and fear of potential hurricanes that could strike Gulf of Mexico refineries. Traders were also watching for signals of where fuel demand is headed in the wake of BP's production woes at its Prudhoe Bay field in Alaska...

Speaking after Iran's military test-fired 10 short-range missiles, Foreign Ministry spokesman Hamid Reza Asefi said a nuclear compromise would have to be reached during future negotiations.

"Everything has to come out of negotiations," Asefi said. "Suspension is not on our agenda."

The U.N. Security Council passed a resolution last month calling for Iran to suspend uranium enrichment by Aug. 31 or face the threat of economic and diplomatic sanctions.

"It is very difficult to decide what to do now in this situation," said Koichi Murakami, an analyst with brokerage Daiichi Shohin in Tokyo..."

Enough said.

Wednesday, August 16, 2006

Trampled by the Bulls

While trying to figure out which way it's gonna go tomorrow, I've got a few long candidates, and even a couple of new shorts to watch. This rally is really burning energy at a breakneck pace, so I'm curious what kind of breather it'll take. The build was so strong today that I suspect the S&P 500 will definitely be up again tomorrow. The price and volume look kinda like last year, March 13-20, which went a slightly down, flat, and recovered again. Is the end in sight?

No one ever said anything about the 'blood in the streets' to explain this rally. And where are those people who think we'll have another big drop in the next month or two? Heck, I predicted this rebound was emminent, but I'm still not quick enough to actually recognize it in time. But, yesterday marked the first day I begin printing the charts of my trades upon entry and exit along with notes. Here's to finally showing some improvement!

Think Thursday will be an upday or not?

Monday, August 14, 2006

And Now for Something not-so-Completely Different.

First, I looked at a weekly chart of a stock to search for targets, then a daily chart. Using Stockcharts.com, I keep their format of RSI on top, MACD below, but place a Force Index below that, and use three exponential moving averages (EMA) in the main chart. Here's three stocks below:

XING looks like it's getting ready to drop. The weekly chart above has a few indicators pointing toward a long-term drop. So I check the daily chart for recent trends.

The daily chart looks like it confirms the long-term trend. I plan to short it tomorrow.

I heard last week that Ford just hired a new executive who is experienced in M&A (mergers & acquisitions). With all this talk about how Mr. William C. Ford Jr. should maybe look into taking the company private, this seems like a very smart move. So, I decided to check them out as a turnaround target. The weekly chart above shows that a turnaround is, indeed, in progress. But, I'm afraid it's already long in the tooth, and I might wait for a minor correction to go long.

The daily chart shows the stock is still pretty strong. Only the RSI is getting into the "red zone" of the stock being overbought. All the other indicators show that this stock is going places, but I'll wait for a pullback before getting in. I just hope a pullback will be worth waiting!

This is a stock that I did for a friend, just to see what it looks like. And it doesn't look pretty. This stock looks like it's just going sideways after a nice runup, and I can't really tell after that. The primary MACD Histogram and EMA slopes are telling me to short, but the RSI is giving a mixed message. Perhaps I'm giving too much credit to RSI?

3 out of 5 indicators are telling me to short, and that's just not confident enough for me to make a solid decision. RSI and MACD histogram slope are going up, but this is short-term, and I'm really not too attached to the trendline that I have drawn. If I had to guess, I'd say HOLX will go up for a brief rally, then come back down in toward my support line.

Sunday, August 13, 2006

Feeding My Head

The second book arrived yesterday, so I have put the first book on pause in my eagerness to read the new one. It is called, "Entries and Exits: Visits to Sixteen Trading Rooms" by Dr. Alexander Elder (I paid less than $50 after shipping at Half.com). I'm already about 1/4 into the book and devouring its insights from other traders. Since I don't know any traders personally, this has given me firsthand knowledge into several trading styles in detail. The book was written at an intermediate level of a Stock Market investor/trader, a level that I believe I am finally pushing into. I'm even proud to say that I had started developing similar approaches to reading charts that these professionals use. I should also mention that everyone in the book appears to be a pure technician.

Back to reality, it's time to take a break from reading to put some new knowledge and enthusiasm to use! Good luck on Monday!

Thursday, August 10, 2006

Score Another for the 'Terrorists'

Now, thousands upon thousands of innocent people have been severely inconvenienced, frustrated, annoyed, and forced to play a part in this charade to tell the world that we are on guard. I was so close to have been traveling this weekend, but now I might not even return back to my contract job in Connecticut just to avoid having to deal with airport security to fly home for the weekend! It was already bad enough that ticket prices are rising.

And how about those markets today? The talking heads at CNBC were all giving their commentary and analysis on why the markets didn't plummet, and why crude oil fell, bonds are up, etc, etc... I still have my theory that there's a lot of active players in the Market, all trying to out-step each other. Everyone's thinking two or three steps down the road, but it's still all speculation. Crude oil dropped, 'because demand for jet fuel will be reduced as people are too scared to fly,' yet the airlines regained their opening losses. Gold dropped while T-Bonds climbed. The dollar rose as the TV journalists claimed it was 'fear in Europe, security in the US.'

It was an up-day today, but the markets opened down as the pre-bell news had the early risers in fear. I'm starting to hear more talking heads say that we should see some better days in the markets for the next month or two, followed by a squall-line of thunderstorms due to a cold front in late Fall. After that, possibly a Santa Claus Rally preceding the final doom-&-gloom final Bear rally in early '07.

Check out these 10-yr charts of the S&P 500.

The lower graph is the Slow Stochastics. During this past 3-yr rally, the SS has indicated bullish and bearish runs in an almost regular interval, although the degree of change has gradually reduced. This has continued until the most recent bearish run, where the degree of weakness is greater, possibly indicating a weakening state. This also concerns me because the SS is showing that it may be preparing to reverse into a bullish run, the current prices don't support that. Slow Stochastics are a lagging indicator, so the S&P 500 should be heading back north, which it is not.

The momentum indicator shown above also supports that the 3-yr Bull Run lost most of its power after the first year. It's had lackluster support through modest gains for 2 years, but does look due for another temporary runup for the next 4-6 months.

Might be time to cover my shorts... for now.

Monday, August 07, 2006

Back in the Saddle

I want someone to start "Hedge Fund Watch." These guys are all tripping over each other, trying to out maneuver the next guy by getting in first on any news. That's still my best explanation as to why GDP is reported down (the economy is slowing!!!) and the market rallies for 6 days. The Wall Street short-term thinking is still the way it always was, but now there is more money in the hands of those who would trade the news. I say betting around the HF's might be a good strategy: see where the money flows on crazy news, and then hedge against it. Could you call that a "Fund Against Funds"?

Futures are down, Europe is down. Is it finally safe to go short on some of those stocks that shot up last week on up-earnings? Volume seems to support that, so here's hoping I can get the money back I lost!

It'll be nice to have Bloomberg again. The hotel I was staying at only had CNBC, and they do somthing in their ads that annoys me. CNBC is constructing their advertising in an attempt to prove to my why I SHOULD be watching them. Notice what Becky Quick says right before commercial on Squawk Box, or the ads as to why we should be watching Fast Money. Granted, I like hearing real day-traders talk (since I don't know any personally), I have to add some salt to the conversation given the venue.

Tuesday, August 01, 2006

Crazy Markets!

The Dow's got a nice channel going. But the MACD indicates that it might not head back down to the support line. Hmmm, a good sign.

The NASDAQ doesn't have too much to go with. But there is the same positive divergence as the DOW. Another good sign.

The Gold Bugs Index closed today with a price that confirms a resistance level. If it goes up tomorrow, I might consider that a breakout. If it goes down, however, then I'd say we're still waiting for the next FED guidance.

The S&P 500 looks like it's moving nicely in a new channel. I don't see a lot pattern confidence here except the resistance level. This might not be a good sign, except consistent bouncing against the resistance might indicate a desparate attempt to break out.

Finally, the bond rate. Bonds seem to be confirming the statements made by PIMCO's Bill Gross last Friday. He forsees a Bond rally soon. Bonds should be rising in the near future, perhaps after one more ride up the channel as the daily talking heads pump up the Fed Watch.

But if Bond prices go up, aren't the stocks supposed to go down?

Monday, July 31, 2006

Can Money Buy Happiness?

--Dr. David Blanchflower, Dartmouth College

Sunday, Feb. 12, 2006 in an interview with James Reese on RadioEconomics.com.

How about that real estate bust goin' down? I'm reading more and more articles about developers pulling out of projects, mounting new home inventories, and falling prices. Is this a good time to become a landlord in my area? And what about all those houses built with immigrant labor in a hurry? How's the quality going to be a few years down the road?

I think this week will be a moment of truth for the markets. After last week's rally, will we see a full turnaround this week? I'm still bearish, myself.

Thursday, July 27, 2006

Monday, July 24, 2006

Stocks for Tuesday

Next, is the Gold & Silver Index. I've outlined the normal Head & Shoulders that I see. I suppose it makes sense that it's moving opposite stocks, since Gold is a defence to falling stock prices.

Here's the sum of the stuff from yesterday. ACO & ERTH stayed within bounds, and aren't going anywhere spectacular for tomorrow.

SCON & REY blew out my first upper resistance lines, but have defined new levels that could also work. SCON might go down tomorrow, but REY should be approached with a new tactic, watching the RSI for reversal, and then short.

Here's the new market movers:

PGH just hit a lower support of $21.85. This should indicate it's time to go long.

Sunday, July 23, 2006

Edgy Gets Technical; Stocks to watch for Monday

I've identified a possible channel, with more recent direction headed down. All these lines indicate that we should see brighter days after another week. Especially when this most recent data looks a bit like an inverted Head & Shoulders patter. The Pennant in the middle of the head might have broken up the pattern, I don't know. But I'll be watching for a breakout in gains if it crosses that sharply decreasing line at the end. Otherwise, it could fall through the support line and down we go.

S&P 500

Next is the Gold & Silver Index. This looks like a VERY prominent Head & Shoulders pattern finishing up! If this is true, expect to see the price of gold falling within a week or two.

XAU

Next, I looked at the market movers from Friday. A few caught my eye for charting, and then I weeded a few more out to mention here. First is SCON:

SCON

The lower line of the channel seems like a bit of a stretch since I don't feel too confident on the data points that created it. However, there are many data points to provide the upper resistance-line. According to this chart, SCON should not move above about $1.66 on Monday. However, this also looks like another possible inverted Head & Shoulders, albeit stretched out and slanted. If so, and SCON breaks above $1.66 tomorrow, it may be possible that it will keep on trucking up for a while, into a new trading range and/or pattern.

SCON probably has enough momentum to break through the resistance line right now. But the fighting between Israel and Lebanon is still hot & heavy, and now the UN is planning on sending in troops along the border when things settle down. That means more countries will be involved in this battle, and that should shake up the markets on Monday.

There's also REY. According to this resistance line, REY shouldn't move above about $32.11 Monday. But my experience has shown me that there are typically two more days of reduced-momentum up-days before this stock 'should' peter-out and drop. But with the bad news abroad, who know how people will feel after this weekend? It might just turn right around and go down. However, this stock looks good for the longer term. It's just at its resistance level and needs to cool off for a week or two. I'll be watching it to see how it pans out.

REY

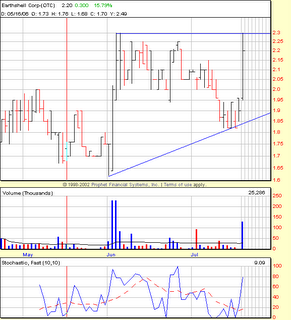

This is ERTH. There is a strong resistance line at $2.30, and another, weaker one at $2.25. The lower support is possibly out of context, but indicates that the price should drop when the triangle closes. I could have also drawn a lower support line starting right AFTER the first jump in price found in the middle of the chart. This would show a widening channel, or a megaphone, which is also a bad sign for the price. My guess is this stock will repeat the behavior of the previous price jump, and bounce its way back down.

ERTH

Finally, ACO. This seems to have a strong channel boundary, which indicates the price will most likely go up Monday, and shouldn't drop below $18.38 throughout the day. However, ACO closed pretty close to the channel midrange of a downward trend. This stock has a wide field to travel Monday, so it could really go anywhere. Normally, I might go long this stock after a drop like Friday's, but it may be best to just watch it a few more days to determine where it lies in the channel.

ACO

I'll see about making further charts using StockCharts.com, dressed up with more details on the chart itself. Until next time!

Friday, July 21, 2006

Recession or Lull?

I suspect that the fighting in Isreal & Lebannon has upstaged the Fed Watch, as Treasuries are finally moving independent of the Fed Rate. I've got some Bonds at 4.9% (darn commisions!), so I say, "bring on the recession fears!". Fear of recession will raise my bond prices so I can eventually sell those and move back into equities. I've begun dabbling in day-trading and learning that I should maybe hold onto my shorts just a tad longer.

Isreal is building troops, and are expected to move into Lebannon this weekend, possibly tonight. At least it will happen while the markets are closed, so that we'll have a day or two for it all to begin before the Wall Street panic ensues. Here's to holding onto my shorts!

Thursday, July 20, 2006

Bounce over already?

Frankly, I think it all points to the common signals these days that investors/traders are very jittery in all markets, countries, and currencies. People aren't letting gains & losses spread too far before they take their money back off the table. I have no idea which way the market might go tomorrow, although I'm suspecting a down day. The indicators that I watch remind me of the instruments on an aircraft panel: they're more accurate when you're cruising. But when you start changing directions, or you're decending slowly in a nose-high attitude (like when you're landing), the instruments get less accurate as the air flow is no longer flowing smoothly into the pitot tube.

Right now, I feel like the market pulled up a little too hard and is going through a bit of a "stall". And the only way to recover from a stall is to get the nose back down...

I'm short across the board: KEA, VOL, LCRD, & MAT. I've been waiting 3 days to short MAT, but it looks like I should have waited only 2 since I couldn't watch it all day. I might drop the VOL in exchange for one or some of the recent movers: AVCI, RIMG (go short), & MOGN (go long).

BERYL: My house is in Florida, my job is in Connecticut. I can't get away from these hurricanes! But I'd rather be here than on the West Coast. Nothing personal, East Coast is just home.

Wednesday, July 19, 2006

Update, Thursday's watch list

RSI is only one indicator I'm looking at, but all the indicators point to some loser-stocks getting seriously overbought. Actually, BCGI looks like it's forming one of those 'cup & handle' patterns.

If I can do this right, I might gain back all that money I spent learning about options with UNH.

About charts and TA, Cramer had an excellent quote today for all us chart & TA learners out there:

If an analyst doesn't like a chart, he'll just draw a different line and explain it all over again.

Ha! Ha! I knew I kept watching that show for SOME reason!

Bounce with me!

I'm expecting tomorrow should be a good day to short Mattel. I was also expecting to see a rebound from 3M, but they are really starting to scare me. I've also given up on United HealthCare until they find a direction and stick with it.

Today's gains relieved the excessive selling from the past few days, but I see that I'm definitely not the first person to say that this evening. The long term sentiment still expects things to go down, so this bounce might be done by next week. We'll see!

Anyone know where oil is really going? I just heard a rumor today that oil distribution companies are expecting lower prices soon, while the talking heads say to look for $100 a barrel before the New Year. I know, I know, don't listen to the talking heads, but I gotta have SOME noise in the background.

Tuesday, July 18, 2006

Utilities, the defensive play

Some signs point to a short-term bottom, as the markets bounce after some hard-hitting days. Across the board, everything has been down: Oil, Gold, Stocks, Bonds, and other commodities. Everything, that is, except the Utilities, who's technicals look inverted to everything else (it's moving opposite, like a defensive sector).

I finally found it after looking overseas to figure out where the money's going. If everything in the U.S. is going down, is it all just going to cash (which MANY people say they are doing)? Despite the Israeli tensions, the Middle Eastern markets were way up today, and India had a good day despite yesterday's train bombing in the financial zone. My guess is people are buying into the panic of these countries, expecting things to get better eventually.

However, fighting and bombing are still going on, and I fear there is more blood to be shed "in the streets." I'd say these investors/traders are jumping the gun (no pun intended), or catching a falling knife. Those markets may likely see more losses in the near future.

Back to the U.S., I expect we'll see a short-term bounce (or "rally" as the media likes to say). But I'm still Bearish overall until I see better signs.

And where's the talk on today's Homebuilder Index release???

Monday, July 17, 2006

Finally off Vacation

Here's a question: With the current fighting in Isreal and Lebanon, and Isreal refuting rumors that it will end fighting soon, why is the price of oil going down amidst this Middle Eastern open fighting?

Possible answer: I heard a trader on Bloomberg radio today saying that it was discovered that during the turmoil and Mid-East oil crisis of the 1970's, oil production in the Middle East continued and oil reserves actually reached record highs. Therefore, there really never was an oil crisis during the 1970's, only speculative hype that put Orwell's 'War of the Worlds' to shame. Meanwhile, weren't we just talking about oil reserves reaching an 8-year high just last month?

Over the weekend, I heard an excellent quote. I wish I knew the name of the man who said it:

"Ethanol is today's Internet Bubble."

By the way, everywhere on TV (except my 2 favorite channels, CNBC and Cartoon Network, which is why they're my favorite) have nothing but the Israel/Lebanon fighting all day & night. I made the mistake of tuning to CNN and can't peel away from the riveting drama of reporters running from falling rockets that stalled on launch. But through all this, did anyone notice that Avril Lavigne got married today? Sheesh! What's happened to news these days???

Friday, June 30, 2006

The end is near! Cats & Dogs living together...

June 28, 2006 2:00 p.m. EST

Nuremberg, England (AHN) - England's s massive army of World Cup fans is reportedly drinking Germany dry, with breweries warning beer could run out before the final game because of huge demand from supporters.

In Nuremberg, organizers revealed 70,000 England fans who flooded the city drank 1.2 million pints of beer-an average of 17 pints each.

According to the Daily Mirror report, one astonished bar keeper Herrmann Murr says, "Never have I seen so many drink so much in such little time," with fans draining all 32 of his 50-liter (11 gallon) barrels available at his city bar.

Murr calculated Britons were shifting beer at a staggering rate of 200 pints per minute.

According to City official Peter Murrmann, "The English proved themselves world champs. They practically drank us dry."

Stuttgart bar chiefs say an extra 900,000 pints were drained last weekend where 60,000 fans partied before and after the 1-0 win over Ecuador. Meanwhile, the Veltins brewery also revealed it produced a record 418,000 gallons in a bid to keep up with demand.

A spokesman says, "It is incredible how much is being drunk but the hardest thing for the breweries is keeping up with the thirst of the English."

Thursday, June 29, 2006

CNBC: more fluff, less nutricious

I'm not a big sports guy, but the first thing I see this morning when I turn on the only financial channel available in my room is talk about MBA picks. They manage to tie it in to money, but we all know it's really for the sports fan in everyone.

After my shower, I come out to see two political hacks trying to out-shout each other with their own rhetoric on offshore drilling for natural gas. I can't believe the garbage that people will say to promote their cause. After that, they moved onto the "FED watch" and played Europe's "The Final Countdown" for the umpteenth time this week.

But I drew the line when they brought in a professional coffee-taster. All the guys on Squawk Box were gathered around samples of black coffee for a lesson in taste-testing. If my wife had suddenly walked in, she would have probably asked me what happened to the regular cast of the Today Show. Although the streaming quotes across the bottom of the screen might have given it away, first.

CNBC is no Bloomberg, but it IS definitely much more entertaining. That's probably why just about every financial office has TV's mounted up high, tuned to CNBC. But, it's finance, how entertaining can that be just by itself?

Wish my office would put up some TV's...

Tuesday, June 27, 2006

All's Quiet

Should the Fed really be such a driver of the stock market? Fed rates have always been a factor before, but I don't see what makes it such a big deal now. Heck, even the price of bonds have already moved to 5.25% in anticipation of a rate increase on Thursday. We've become so distracted with what Big Ben Bernanke is going to say that we've overlooked the fact that oil is just plain overpriced. Crude oil prices have long been subject to the slightest speculation because of the volatility of the nations that produce most of it.

Frankly, I think we've been getting the short end of the stick for several years now, to the benefit of OPEC and commodity traders. They're making HUGE profits now, and have enjoyed the good times while it lasts. Oil is a cyclical business, and prices will fall again. OPEC knows it, just listen to them talk. And the Middle East will struggle to cope when all their hundreds (thousands?) of Sultans suddenly find themselves without an income to support their very excessive lifestyles. Only the United Arab Emerates seems to have built an infrastructure to support non-oil industries. It's risky, but I would like to look there for places to put my money.

Monday, June 26, 2006

Everything you've learned about the Stock Market is wrong.

As for today, it's very interesting to watch the Markets leading up to the Fed announcement. There's just not a lot of volume right now, and all the indices appear to be forming a decreasing sine-curve around a mean. In other words, they're hovering within a certain range, just waiting.

We still haven't seen the next big drop that many analysts are predicting. Has anyone else heard about a major turning point occuring on July 10?

Friday, June 23, 2006

Oil's Goin' Down! (um, when?)

But here's the real story: he mentioned that the oil companies in general are planning around oil moving to $45 a barrel. It's a lower target than what I heard on Bloomberg the other day, but it appears that the analysts are agreeing on a range.

APC's already down 10% in pre-market trading on the news, making the market cap drop below the loan value. KMG is up to 68.91 right now, and the sale price is offered at 70.50. It will be interesting to see how the price moves after the opening bell. A nimble trader might get an opportunity to ride a quick inefficiency.

Thursday, June 22, 2006

House of Cards

Crude oil supplies are at the highest level in 8 years, even the Saudis are cutting production because they have nowhere to put their extra inventory. The bottleneck is now at the refining capacity, if there is a bottleneck. What was the price of oil 8 years ago, May 29, 1998? $15 a barrel, and later dropped to $12 by the end of the year! See Chart

Today, the quiet experts are saying that the fundamentals for drilling crude is $50-$55 a barrel. And even the Oil Sands of Canada can stay profitable above $50. Aside from the Oil Sands, I think there's even more breathing room for oil to drop if the floor falls out. And if it does drop back to those levels, watch the UAE for some moderation in its unbridled real estate development.

This supply report helped me to understand the fundamentals behind the early signs I thought I could see. I was wondering why Chavez and his Venezualan gang were pushing a $50 floor on prices instead of the supposed $25 floor. The rest of OPEC, of course, denies that there is any price target. But as Venezuala's comments were shrugged off, even the Saudi's had some comments that displayed concern over prices becoming too low. I kept asking myself why all this bearish talk from the producers when the train is still hauling at full steam.

There is a glut of supply in crude oil. The U.S. has a glut of supply of housing, whether we'll admit it or not by looking at housing starts. It all appears to be a "house of cards", waiting for a slight wind to make it all come crashing down. When it does, I expect to see the stock markets crash with it. But, I also expect to see the large cap stocks to be the first to recover as the survivors move their money into the tried-and-true blue chips.

That's my prediction for today. The real trick is to be able to tell when it comes!

Tuesday, June 20, 2006

Break's Over

But who's buying Index ETF's anyway? Here's to UNF dropping another $5, I've got options to cash-in!

Saturday, June 17, 2006

Da Bears-s-s-s-s!

Still, I see longer-term indicators on many stocks (retail) looking good. And I'm finding long-term sentiment in the Smart Money is still bullish for Q4 of this year. Even Cramer (sorry if I don't associate him with the SM above) says July should be a good time to snap up clothing stores before the back-to-school rush, and I agree. Not that I have to validate the Mad Man of Wall Street, but I'm reading the tea leaves myself. And it looks like I'm seeing confirmations that this is still only a short-term market recession.

Good luck, and stay strong!

Thursday, June 15, 2006

My Crystal Ball?

But what I found most interesting is that the trend from these MACD histograms would require about another 10 sessions (8-13 is the range) before we might see confirmation of a long-term rally. Suspiciously, the next Fed rate release is scheduled 10 sessions from now on June 29, the day after my birthday. I'd say it is coincidence, but I'm sure we'll see some strong movements as soon as Big Ben makes his announcement.

Wednesday, June 14, 2006

A Little Relief

I see MACD curves on the indices showing positive divergence, signalling the end of down days approaching.

Interesting, Cramer just mentioned all the margin calls that are going on this week. It just so happens that I heard from a trader yesterday who was saying that he noticed a record number of margin calls. A lot of investors were forced to liquidate their positions, selling stocks to pay off margin loans. Brokers putting some of that money back into stocks might be part of the reason things went up today. I noticed a final upturn in the last hour today, that might be a good sign for tomorrow!

I'm sticking with the theory that by Wednesday next week we'll be down again. Now, I'm thinking it might start Monday.

Monday, June 12, 2006

Dead-Bull Bounce

I don't think this Bearish cylce is over. Everyone is still rambling on about what the Fed is going to do next, although I think they're finally getting tired of it. People are all over the board on whether Big Ben Bernanke is going to raise rates one more time, but the more recent forecasts believe he's going to do it. I don't know, but it's starting to look like I grabbed my 30-yr bonds at a pretty good price.

Meanwhile, I see the high-paid money managers and analysts on K&C saying they would 'buy' tomorrow, and Jim Cramer opens up talking about 'bottoms' while showing a pic of J-Lo sporting some jeans. He's blaming the whole Bear market on Ben & the Fed, but I say Ben inherited the recession (say, haven't we heard something like that before?). I hear a joke originated at a trading desk in Canada about the death of Abu Zarqauwi, saying "They got the wrong guy!" next to a picture of Ben Bernanke. They've been upset for over a year, now it's turning to hatred! Love hurts, eh?

I've opened up a game on MarketWatch's Virtual Stock Exchange. It just started last Thursday and is on until the end of the year. If you're interested, email me and I'll send you an invite.

Thursday, June 08, 2006

Computer Nerds will Rule the World!

But as I think about it, technicals tell you when to buy and sell. Why bother with fundamentals if one is going to bother with technicals? I suppose I'm really comparing apples & oranges, there is probably a time and place for everything.

So, while I'm still finishing up the details on the fundamentalist program, I've been tinkering with technical analysis programs. If anyone out there uses software that they are proud of, I'd be happy to hear about it!

Tuesday, June 06, 2006

The Soothsayers are getting louder

He believes there is "excess" in the market, and is looking (even hoping) for another Bear rally soon to provide opportunities to buy good stocks from late in this year to early next year. They just aren't sure exactly when, but they believe it will happen.

He just laid out everything I've been piecing together all in one sitting. This is just one more comfirmation of the theories I've been hearing from the "quiet" newsmakers of the Street. And I think it's about time to start finalizing strategies to approach this (Puts, anyone?).

Saturday, June 03, 2006

The 30-YR Bond Test

I was going through all the records I've made so far in efforts to debug the program. And I started noticing something about a special feature that I had requested: a red flag that signals when a company's initial rate of return (ROR) is less than the current 30-yr bond (or T-Bond) rate.

First, let me explain how I make this comparison. I treat the current diluted EPS as a yield. To find the yield rate, the yield is divided by the price, just like bonds. If a company's initial ROR turns out to be less than the highest-yielding bond rate (usually the T-Bond unless you have an inverted yield curve), then you might as well put your money into the bonds until either earnings rise or the stock price falls... OR until the T-Bond rate drops. DISCLAIMER: This is treating your stock like a bond, and ignores potential earnings growth and any other factors that could influence the future price of the stock.

I noticed a lot of companies were giving me this red flag mentioned above. So I decided to count how many companies are "worse than bonds" right now. I got 21 out of 44, that's 48%. About half of my companies are estimated to give out less money than the 30-yr Bond! And many of those that did beat the T-Bond were not much higher. Those that excelled greatly in initial ROR included financials like CFC, LFG, FMT, & NEW (but not CBH), and housing stocks like BMHC, HOV & KBH. The losers included technology, healthcare, pharmaceuticals, and insurance, while retail and manufacturing is right about at the same level. I also noticed that a company's P/E had nothing to do with my results; some companies that failed the test had lower P/E's than those that passed.

This makes me think that I should look into buying some bonds soon. I'm still looking for signs to prove the theories I've been hearing on another market correction within the next few months. If this happens, bonds should be in demand until the 4th quarter recovery (also part of the theories). Other theories predict a soft recession for the rest of the year, with no guidance after that. So, as I said, I'm still looking for rules on reading the tea leaves.

For your information, right now I have only 47 companies on file. This isn't much, but considering the Dow Industrial Average contains only 30 companies, I'd wouldn't worry too much about it. 4 of my companies are also on the Dow: HPQ, JNJ, PG, & UTX, and there's a few more I'd like to add; only JNJ passed the T-Bond yield. I eliminated 3 companies from this analysis because of their questionable earnings conditions: KKD, SLR, & SUNW.

Thursday, June 01, 2006

How about that?

| You Are Bart Simpson |

Very misunderstood, most people just dismiss you as "trouble." Little do they know that you're wise and well accomplished beyond your years. You will be remembered for: starring in your own TV show and saving the town from a comet Your life philosophy: "I don't know why I did it, I don't know why I enjoyed it, and I don't know why I'll do it again!" |

BUY! BUY! BUY!

I heard a second source this morning predict that there should be a short recovery followed by a lower low before we see a true rally later this year. I might try to ride this short wave with more stop-limit orders, and possibly a few puts to get this theory to work. Here's to the chase!

Friday, May 26, 2006

Thought for the extended weekend

So, let's say housing is going down. Commodities are in full Boom, with the Bulls predicting 4 to 6 more years of rising prices in gold, oil, zinc, copper, uranium, etc... Then there's the undercurrent of talk that the Fed will lead us back to a recession with its full-speed money printing & interest rates. I've been listening to Wall Street gripe about how the Fed has overstepped its bounds by raising rates too high, too fast since a year ago.

That's the way I see the Big Picture right now. My question is this: where's the next Bull market? Perhaps I've missed the commodities boom, or maybe there's still time. But, where is today's beaten-down value that is waiting to burst in to 2,000%+ gains like metals did recently? As it happens, Jim Cramer right now is saying to look at "secular growth stocks", or cyclicals (but it's a rerun! I saw copyright 2005 at the end). Cyclicals will follow the economy... but isn't the economy teetering on trouble?

Where's an amateur to put his money right now???

Thursday, May 25, 2006

The Herd, explained

"It is better to fail conventionally than to succeed unconventionally in many instances." -- Keynes

Wall Street is populated with many people who come from similar backgrounds, have similar training, and work in a similar environment. They are in a natural herd, and the herd mentality comes with the territory, because it's about survival. To complete the analogy, who wants to be the stray gazelle that gets picked off by the predators? Therefore, analysts, strategists, and economists keep their predictions within a range, so as to avoid become the outlier to be removed. There is a psychological tendency not to fight the flow, and bend into peer pressure. He views Wall Street research as no longer a real profit center, outside of [investment] banking.

That gives us outside amateurs a certain advantage of having a unique background and point of view. Most of the guys on financial news networks are mostly just reading what is handed to them, and many of them get their news from similar sources. It's kinda like the AM radio talk show guys I used to listen to religiously, I don't get the time to listen to them so much any more. But when I could listen all day, it was show after show of the same "news" & topics all day long. It's like a list of talking points was printed early in the morning, and they all read from the same page for their particular show.

The current convention is usually not right, that's the mantra of a typical contrarian investor. The trick is figuring out when the rest of the herd will realize that, and then keeping a step ahead. I don't think it's really that difficult for the average amateur. There are so many sources and tools out there for each of us to develop our own investing & trading strategies. As long as one can follow what he/she learns and knows instead of following the crowd, anyone can succeed.

Tuesday, May 23, 2006

Just another day...

***

Stocks had shown signs of stabilizing after suffering nearly two weeks of declines as the market fretted about interest rates and the economy's health. But investors clearly were still nervous about keeping money in the market while they remained uncertain about the Federal Reserve's plan for lending rates. Full Story

***

I am still awed at how the Markets react to news. If we WERE certain about the Fed's plan for lending rates, how would today have gone any different? What would the Dow be doing this week if Ben Bernanke actually publicly stated the future Fed Funds rates for the rest of this year? What would happen if I manage to complete a post without mentioning 'energy' or the 'Fed'?

Monday, May 22, 2006

The Herds are Everywhere!

But that's not the half of it. In the same article, an expensive, institutional economy report is cited:

Bridgewater's conclusion:

"The supply of U.S. bonds that is being dumped onto the world is still monstrous, and foreigners desire to hold them is rapidly declining... In order to stimulate enough demand to buy the massive supply, yields have got to rise and the currency has got to fall. This adjustment has barely begun." ***

It shows that foreign investment is, in fact, a serious factor in the price of US stocks and bonds, and subsequently our economy. The above is a prediction that the value of the US Dollar will continue to fall, and the Fed rate will continue to rise (or rather, they must).

BUT FEAR NOT! The note is concluded with the following timeline:

Long-term optimism. [Don] Hays writes: "Inflation fears will cause big Fed worries, but if we are right we will see the core rate settle down 3-4 months from now. So that fits with market unrest here, and then the return of a healthier bull market in a couple of months."***

Statistics show that we'll have another down market next month with lower lows than this month. A falling dollar should raise the value of foreign stocks & currencies, and it might be a good idea to put money into a savings account or bonds for the next few months. More statistics show that the second half of this year should see a happy ending, but aren't specific as to when. My guess right now is that we'll see an honest bull market near the line between the 3rd & 4th quarters, or mid-August. Until then, don't be fooled! Any run-up in prices may be short-lived, and I'd be ready to jump with stop limit orders.

As if this post shouldn't get any longer, more oil speculation is making me sick! A member of OPEC mentions that he will suggest a reduction in production next week. So, what do we see today? Commodity traders are buying up the oil supplies... er futures in anticipation of what might happen. And, of course, we'll see the results of these future prices in our present-day gas pump prices. When things calm down and we discover that the production cut won't do much to supplies, the futures prices will fall while today's gas pump prices stay high. If no news happens for a week or two, then the refiners will timidly edge their prices down in free-market competition.

Ugh, feeling a bit queesy in disgust. On the bright side, all the Bulemia I get from reading about oil prices might help me drop those 50 pounds I've been meaning to shed...

Friday, May 19, 2006

Edgy Gets Political

Here's a theory: many people believe the US has numerous oil reserves in the ground. We could drill here, as we have in the past. But we don't drill because our society is so elegant now that it cares more about the "Environment" than our natural resources. I'm not trying to say that being environmentally concious is a ludicrous concept. Just because some people, who have made fabulous success in earning wealth in their lives by using an excuse of what we would call "work", and have taken up these causes with fanatical fervor in order to balance their personal perception of their level of Karma, or because they feel environmentalism is an excellent excuse to promote their personal, political agendas, doesn't mean that EVERYONE who talks about environmental issues is a loopy, wing-nutty, robotic, script-spewing fanatic.

Back to oil producing nations. Where is oil drilled? Is it downtown of a city? Now, I've seen an active oil pump in the middle of a shopping center parking lot in the outskirts Oklahoma City, but which do you think was there first? Many drilling sites are under-developed for a variety of reasons; they have jungles, deserts, remote mountain ranges, people nearby may be living in rural squalor, and the vast majority in poverty. You think they're worried about the "Environment"? You think Nigeria, Saudi Arabia, or Venezuela doesn't have more important things to worry about than if this one, particular activity of drilling for petroleum will adversely affect the local wildlife and fauna?

What the heck happens with sprawling cities, whether they're made from skyscrapers and suburbs or from shacks? Why aren't we concerned about the "Environment" when we're building thousands of square miles of condos and houses to keep up with this real estate craze we've been experiencing? You have to knock down trees to clear room for a building!

My point is this, we don't drill within our borders because we are concerned about affecting the local "Environment", the local wildlife, the local citizens, and let's not forget that Washington has been in bed with the Middle East for 20 years already. But we're not supposed to know about that... I guess there's some other perfectly good reason why the oil drilling boon of the 1980's suddenly dried up (remember that show, Dallas?).

In short, it appears that America is just "too good" to drill its own oil. So we have to head across the tracks, and make our way to the crackhouse to get our fix from the gun-toting thugs that own that turf. They flip us the bird as soon as we turn our backs, but then quickly count their money. As long as we have cash, they'll keep smiling to our faces (yeah, you, Chavez!).

Thursday, May 18, 2006

Fool's Gold, & A Rant on Futures

I'll admit that fears on the core CPI did influence yesterday's selloff, but it was already going to be a down day. The bad news only made a bad situation worse. Even oil was down, although it is up today. I subcribe to the view that markets this year will be down in the first half, but will rise high during the second half.

Oil was down because, as people say, demand is also down from the high costs. But Energy analyst Victor Shum of Purvin & Gertz in Singapore said it remained too early to tell if demand had indeed been significantly hurt by high oil prices, which are still about 40 percent higher than a year ago. The fluctuating price of energy (oil) is determined by those commodity traders who buy and sell oil all day long. The words "Iran" and "nuclear" were mentioned in the same sentence, and traders began buying it all up in speculation. Now, we all pay the price for media hype. There is no standoff, there is no invasion, and the selloff (profit taking) begins. It sickens me how we must pay for speculation, not facts. The FUTURE price of oil is up, so the refineries raise their CURRENT prices in anticipation. Perfectly legal, and we pay for other goods this way, whether it's gasoline or a can of beans on the shelf.

Last Friday, there was a pipeline explosion in Nigeria, a country fraught with insurgents who have been attacking oil facilities. Did the price of oil shoot up in an orgy of speculative fear-mongering? No. The excuse? The explosion was caused by "vandals" attempting to steal oil, not "militants" attempting to disrupt supply. The supply was still broken, but the source will affect the price of oil? Our prices were affected when they blew up part of an offshore platform, taking out 20% of Nigeria's capacity, it supplies about 20% of US oil imports.

Wednesday, May 17, 2006

More Excuses for the Bears

Today's excuse is the media looking for a reason to explain the situation, but it's a short-term explanation for a long-term view. Stocks have been falling since the day after the Fed released it's latest rate increase last week! AND has anyone noticed that the commodities are also falling, including gold? Today, I finally heard someone say that the money is flowing into bonds, but that wasn't the case before today. Hmmmm....

Speaking of the Fed, Chairman Ben Bernanke made a speech today saying that the government should stay OUT of hedge fund regulation. HOO-RAH Ben! Score one for the free-market capitalists against "creeping socialism" and beaurocracy! By the way, the Federal Reserve Bank is NOT a government entity. Ben Bernanke does explain and discuss the situation with the President of the United States, but he doesn't report to him.

However, the Fed is not a friend of Wall Street. Every talking head on Wall Street has been griping about the Fed's rate increases (9 in a row, now) and how it is stifling the economy. Today, I heard them say that it may be too late to save the economy after this last increase. Is THIS the sentiment that caused the Down-200 day?

While the markets have been falling, the dollar has been rising against the Yen and the Euro. My guess is this is because people are cashing out of overpriced stocks and holding cash and US bonds. I bet foreign investment may have a play, too. They might see prices falling and could be converting their currency to dollars to buy up more American opportunities.

Just remember, the market is falling, not the country. We still have fundamentals, so what goes down WILL come back up!

Tuesday, May 16, 2006

The Bloodbath

A few weeks ago I jumped out of a lot of my holdings, thanks to trailing stops. I checked my own meager portfolio to see that the few bets I'm holding onto right now are bleeding me: my small stake in Chinese-owned General Steel, my retirement savings in the S&P 500, and my bearish bet against Coventry Healthcare. To add insult to injury, after holding (and dropping) Countrywide for 18 months, I see it now reaching new heights that it never could rise above during my tenure. This is the kind of stuff that kills the weak of heart... and stomach. But only if you drop out now.

Thursday, May 11, 2006

MacroEconoCrochet

As for me, I'll remember that I'm still working toward being primarily an investor in companies traded on US exchanges. I'm not already trading global markets on the forex, so I'm not going to worry about trying to figure out the economic consequences of the devaluation of the Rinminbi (sometimes called the Yuan, or Juan in Southern China) being unpegged against the US Dollar. Stick with the basics and everything else will take care of itself: focus.

Jack Welch once told a large group of students that the best tip to success is focus. He said that, whatever you do, find something and stick with it. In today's ADHD environment, I'd say that's pretty good advice. Hell, it's taken me over 2 hours just to write this dang bit because I've been downloading Podcasts and watching Adult Swim! Now that's not very responsible, is it? As I always tell my son, "Do as I say, not as I do."

Wednesday, May 10, 2006

Oh no, it's the Feds!!!

Well, of course the Fed will be closely watching economic data! Is that supposed to be a new concept for them??? I think Ben Bernanke is asking himself one question for every report he publishes, "can I make Wall Street think I'm unpredictable?". Mr. Bernanke is still trying to prove that he is not the Mini-Me of Alan Greenspan, and can actually think on his own.

It's almost fun to watch the Wall Street herd jitter and jump every time a croc or lion is spotted, whether there is one or not!

One interesting note, a colleague at work stopped by my desk today to ask, 'what's going on with the markets today? They're going down.' I didn't know what he was talking about, because I have been watching the healthcare stocks like UNH and CVH to see if they'll continue to plummet. The past few days, they've been rising dramatically. And that is ONLY because I put money down against CVH!

Here's to the Game, and my first post!