Well, well, well. A plot was foiled in which "liquid explosives" were going to be used to detonate airlines in the air. So what's the kneejerk reaction? Immediately confiscate ALL liquids brought on by passengers today... and for who knows how long? I didn't hear of a single incident of any liquid explosives actually being confiscated today, nor would we.

Now, thousands upon thousands of innocent people have been severely inconvenienced, frustrated, annoyed, and forced to play a part in this charade to tell the world that we are on guard. I was so close to have been traveling this weekend, but now I might not even return back to my contract job in Connecticut just to avoid having to deal with airport security to fly home for the weekend! It was already bad enough that ticket prices are rising.

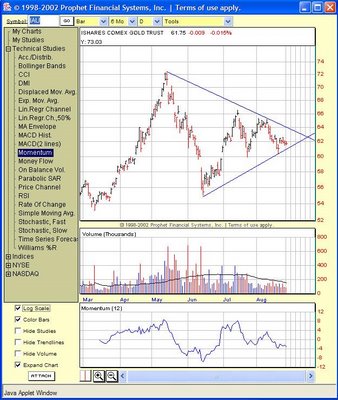

And how about those markets today? The talking heads at CNBC were all giving their commentary and analysis on why the markets didn't plummet, and why crude oil fell, bonds are up, etc, etc... I still have my theory that there's a lot of active players in the Market, all trying to out-step each other. Everyone's thinking two or three steps down the road, but it's still all speculation. Crude oil dropped, 'because demand for jet fuel will be reduced as people are too scared to fly,' yet the airlines regained their opening losses. Gold dropped while T-Bonds climbed. The dollar rose as the TV journalists claimed it was 'fear in Europe, security in the US.'

It was an up-day today, but the markets opened down as the pre-bell news had the early risers in fear. I'm starting to hear more talking heads say that we should see some better days in the markets for the next month or two, followed by a squall-line of thunderstorms due to a cold front in late Fall. After that, possibly a Santa Claus Rally preceding the final doom-&-gloom final Bear rally in early '07.

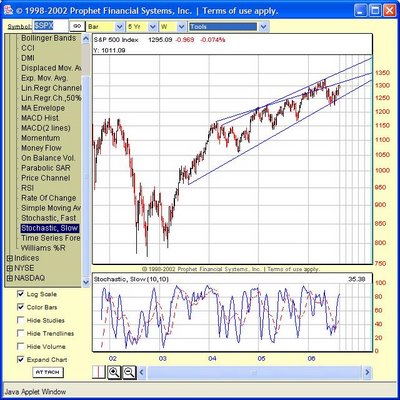

Check out these 10-yr charts of the S&P 500.

The lower graph is the Slow Stochastics. During this past 3-yr rally, the SS has indicated bullish and bearish runs in an almost regular interval, although the degree of change has gradually reduced. This has continued until the most recent bearish run, where the degree of weakness is greater, possibly indicating a weakening state. This also concerns me because the SS is showing that it may be preparing to reverse into a bullish run, the current prices don't support that. Slow Stochastics are a lagging indicator, so the S&P 500 should be heading back north, which it is not.

The momentum indicator shown above also supports that the 3-yr Bull Run lost most of its power after the first year. It's had lackluster support through modest gains for 2 years, but does look due for another temporary runup for the next 4-6 months.

Might be time to cover my shorts... for now.