Still working overtime this week, trying to meet deadlines. In my "spare" time I've looked on the markets and saw the Indices had a Doji day. It's look pretty bearish for many of the popular names (go FAZ, TMF), but a couple of dollar stocks are showing strong interest while the prices still remained flat.

I'll be keeping an eye on ABAT to continue it's runup, AXL, CENX, UIS, VSH, and ZIGO. On the 5 min chart they look promising, but on the 60 min charts they might only be pulling some bear flags. I won't put any money in until resistance is tested at least twice.

Right now I'm 100% cash, as I don't have much time this week to watch the markets.

Tuesday, June 23, 2009

Monday, June 22, 2009

Volume doesn't exist

Can someone tell me why my Prophet chart in ThinkOrSwim's trading platform will not show volume data for the S&P 500 or NASDAQ indices? Before exploring TOS, I've been a regular on Prophet.net to use their Java charts, and I've noticed their volume data for the S&P started to be missing around the time of the March rally. There's a little in April, then it's gone again.

Here's the TOS chart, different scale but same story.

Fortunately, Stockcharts.com is still coming through. RSI and the short-term MA's are at a similar situation to where they were around May 21, which led to more rally action. However, we've also crossed the 200 MA, which should provide added support. But the volume and price-action is looking bearish for the short-term.

I'd say Monday isn't looking too good, but there is Strong support at 910. But if it breaks through, I'll be watching the next support at 894. I'm 100% cash right now, so I'm looking for opportunities, long or short.

On a side note, I took a short walk this Father's Day while visiting the in-laws. I walked up to the local Buick/Pontiac/GMC dealership up the road from their house after it had closed for the day. As I browsed the lot, I started by ogling the GMC Yukons, and noticed that the first one I saw was priced over $59,000. Man, my first house almost cost that much! These days, it's no wonder these cars aren't selling.

As I moved on, I saw the Pontiac G5's and G6's that they had to liquidate ('cuz GM is terminating the brand). I looked at one particular G6 with some bells and whistles, and couldn't believe the price was over $23,000. In 2001, I bought a new Chevy Impala, and got the "employee discount" (for other reasons) and bought it for $22,000, 5-yr loan with 0% interest. I still have that car, and it's about 20% bigger than this G6. I just couldn't see inflation being so great that this smaller (yet newer) car would cost more than my family-wagon only 8 years later. Then I saw that it was a 2008 model....that car could be sitting on the lot for almost 2 years!

Prices need to correct, just like in houses and stocks. I sure hope this purging process we're going through will truly clean out the system for a while. Even if the cars come out more 'inferior' for the next few years, I would like them to at least be priced right! Enough said, it's after 1 AM and I have to go to work in a few hours.

Here's the TOS chart, different scale but same story.

Fortunately, Stockcharts.com is still coming through. RSI and the short-term MA's are at a similar situation to where they were around May 21, which led to more rally action. However, we've also crossed the 200 MA, which should provide added support. But the volume and price-action is looking bearish for the short-term.

I'd say Monday isn't looking too good, but there is Strong support at 910. But if it breaks through, I'll be watching the next support at 894. I'm 100% cash right now, so I'm looking for opportunities, long or short.

On a side note, I took a short walk this Father's Day while visiting the in-laws. I walked up to the local Buick/Pontiac/GMC dealership up the road from their house after it had closed for the day. As I browsed the lot, I started by ogling the GMC Yukons, and noticed that the first one I saw was priced over $59,000. Man, my first house almost cost that much! These days, it's no wonder these cars aren't selling.

As I moved on, I saw the Pontiac G5's and G6's that they had to liquidate ('cuz GM is terminating the brand). I looked at one particular G6 with some bells and whistles, and couldn't believe the price was over $23,000. In 2001, I bought a new Chevy Impala, and got the "employee discount" (for other reasons) and bought it for $22,000, 5-yr loan with 0% interest. I still have that car, and it's about 20% bigger than this G6. I just couldn't see inflation being so great that this smaller (yet newer) car would cost more than my family-wagon only 8 years later. Then I saw that it was a 2008 model....that car could be sitting on the lot for almost 2 years!

Prices need to correct, just like in houses and stocks. I sure hope this purging process we're going through will truly clean out the system for a while. Even if the cars come out more 'inferior' for the next few years, I would like them to at least be priced right! Enough said, it's after 1 AM and I have to go to work in a few hours.

Thursday, June 18, 2009

AtLas(t)

The Atlas V carrying NASA's LRO/LCROSS missions took off this evening at 5:32 pm EST. I went out to the parking lot for the building where I work across the bay to watch it. I couldn't see it because of the low cloud cover, but BOY! was that thing LOUD! The rumbling just kept going...and going... I could definitely tell the difference from Shuttle launches that I've seen from even up close.

BTW, we're across the bay because NASA can't seem to find room for us contractors on Center. Since we're working on the new launch vehicle, I'm sure a few spots will open up in a year or two, after Shuttle winds down.

In the Markets, I pulled out of my losing FAZ and TMF positions. Both had worked stellar yesterday morning when I got them before they turned on me. TMF shot down from one Fibonacci line down to the next before stalling. FAZ took its time, but it's there too. Now I'm back to 100% cash while I step back and take another look at what's going on. I've been so busy with work and doing overtime that I haven't been able to check much lately. I don't think I'll get much breathing room until July.

Meanwhile, I had to return that book to the library and ended up buying it on Half.com. The book again is: All About Technical Analysis by Constance Brown. I'll be reading it upon my leisure (pronounced: lez-shure) for the next couple of weeks to help me work on a new plan of action.

The markets are so choppy, and people are getting more aggravated about which way things might go in the short-term. One interesting note, I heard on Bloomberg today that a certain, successful hedge fund is looking to bet on mid/long-term hyperinflation. I wonder if I can do that through the Bond-short ETF's and commodity ETF's (both long and short)? Dollar Index is going down, which is going to cause a rise in commodity prices. I've got this itching feeling to get my money out of "US Dollars" for the next 5 years.

Tuesday, June 16, 2009

Shuttle Launch: Redux

Ok, second chance to drag the family to go see the Shuttle launch tomorrow morning. I say, "drag" because the launch is now at 5:40 AM, I have to be inside the gate within an hour before launch, and it takes almost an hour to drive there. Soooo.... that means getting up around 3 AM or so and loading up the car. At least this should count as a night launch and the sun won't be in our eyes like the last date. Here's hoping!

As for the Markets, I've been in cash since last Wednesday, and I'm glad I did. Although Thursday would've been a better day, but that was probably short-buying getting ready for this week. Judging by the Daily chart, I see more slippage down to daily RSI of 45, and then to 40. That should time about right with the Yellow Channel/Blue Fibonacci intersection I have in the chart below. It predicts S&P 500 could see an important pivot point around 894 on Thursday around 11:30 AM.

I might buy a little FAZ to ride this down, but it's too early to get brave with swing trading.

30-yr Bonds still look like prices are rising, as yields keep falling. Someone's buying, but I don't know who. I'm still bearish long-term on these bonds, and continue to keep an eye on TMV.

However, the 30-yr Bull 3x ETF: TMF is riding a significant Fibonacci retracement level (38.64). If it punches through I'll look for a good time to jump on board to the next level around 42.50, as a short-term swing play. After all, you have to be active with these multiplier-ETF's or you'll lose money due to time-decay.

As for the Markets, I've been in cash since last Wednesday, and I'm glad I did. Although Thursday would've been a better day, but that was probably short-buying getting ready for this week. Judging by the Daily chart, I see more slippage down to daily RSI of 45, and then to 40. That should time about right with the Yellow Channel/Blue Fibonacci intersection I have in the chart below. It predicts S&P 500 could see an important pivot point around 894 on Thursday around 11:30 AM.

I might buy a little FAZ to ride this down, but it's too early to get brave with swing trading.

30-yr Bonds still look like prices are rising, as yields keep falling. Someone's buying, but I don't know who. I'm still bearish long-term on these bonds, and continue to keep an eye on TMV.

However, the 30-yr Bull 3x ETF: TMF is riding a significant Fibonacci retracement level (38.64). If it punches through I'll look for a good time to jump on board to the next level around 42.50, as a short-term swing play. After all, you have to be active with these multiplier-ETF's or you'll lose money due to time-decay.

Thursday, June 11, 2009

Golden Ticket

I just scored front row seats for me and my family to watch the STS-127 Shuttle Launch this Saturday morning. Since I work here, I usually get to see these launches up close, but now I get to bring the kids. Here's the approximate location:

http://tinyurl.com/l6wabz

The pad is about 3 miles NE of this spot. If you look around, you can also see the crawler with an empty mobile launch platform near the upper pad, not far to the North.

As for investing/trading, I ended up pulling out of all positions yesterday. After first getting stopped-out of ILMN, I examined the others and saw breakdowns across the board. Since my account is all cash, I have to wait three days for settlement before I have access to that money again for trading. I'm out until Monday, which is just fine since I've got too much going on otherwise.

Besides, it will be good to take a step back for a breather, and to get a fresh look on where the Markets are going.

Wednesday, June 10, 2009

Hardly Working

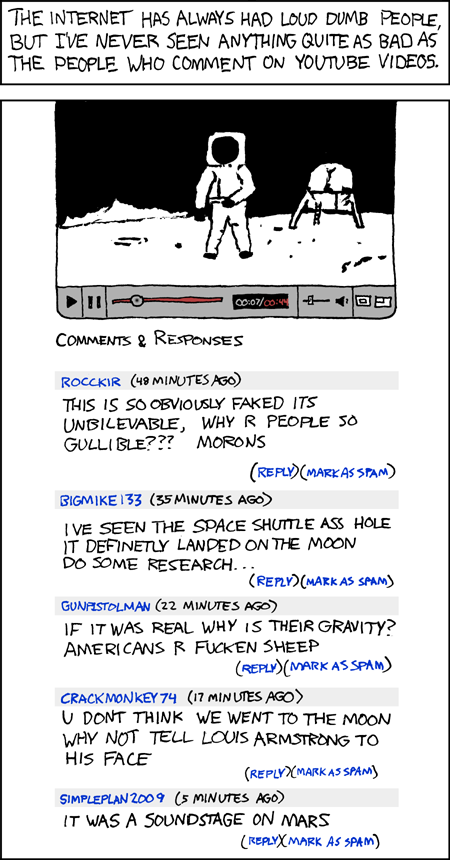

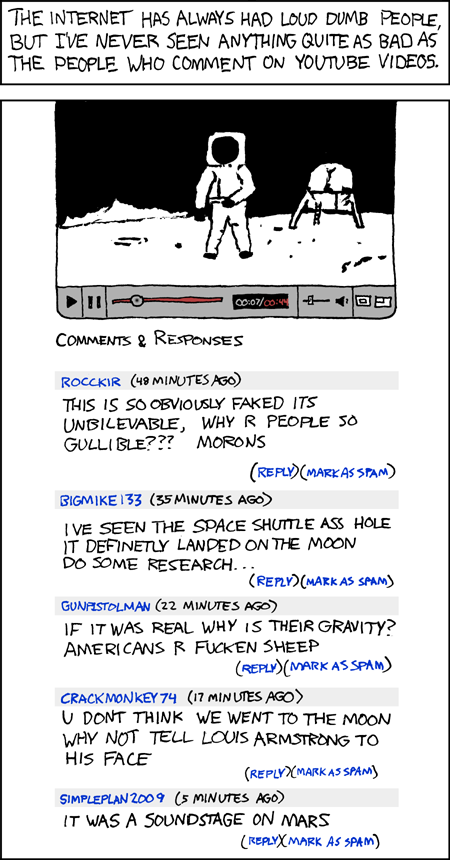

Random Comic, courtesy XKCD. Hint: If you go to the website and read the real comics, then mouse-over the image to get an extra punchline.

I hate it when work gets in the way of my trading. We have a big deadline at the end of this month, and it's crunch-time to get everything looking good; I might be looking at some overtime. Meanwhile, the wife is going crazy at home with the kids out on summer vacation, and I need to replace the starter in my car.

Trading update: still holding all positions with a continued positive outlook. I am practically 100% in the market (or 0% cash) with active stops, and I check up on all my trades periodically during the day. All positions are long except TMV, which is a 3x ETF that shorts the 30-yr Treasury Bond.

Portfolio +1.47% today, while the S&P 500 was +0.35%.

I hate it when work gets in the way of my trading. We have a big deadline at the end of this month, and it's crunch-time to get everything looking good; I might be looking at some overtime. Meanwhile, the wife is going crazy at home with the kids out on summer vacation, and I need to replace the starter in my car.

Trading update: still holding all positions with a continued positive outlook. I am practically 100% in the market (or 0% cash) with active stops, and I check up on all my trades periodically during the day. All positions are long except TMV, which is a 3x ETF that shorts the 30-yr Treasury Bond.

Portfolio +1.47% today, while the S&P 500 was +0.35%.

Monday, June 08, 2009

If you aren't churning, you aren't learning.

I got nervous this morning as everything stumbled and fell. All my holdings were down about 2% but still "within tolerances." No stops were triggered, and all my holdings seemed to stabilize after the morning session. A few of my holdings even rose back up, and I got confident again, even enough to get back into my 30-year Treasury Bond, triple-short ETF: TMV. I even managed to get it near an intraday low of 90.80, and it closed at 93.76.

I also bought OSCI on pure speculation, and it's making me sweat as it held steady all day. Closed neutral, minus brokerage fees.

With three up and three down, I ended today +1.25%.

These guys are still making me nervous:

ABAT (-1.62% today)

Still painfully drawing out that ascending triangle, which doesn't converge until June 18 or June 23, depending on which resistance you're using.

AGO (-1.23% today)

Ended today on a promising recovery.

ILMN (-2.08% today)

Still looking for direction, but it appears that the bears are in small numbers compared to the bulls. So, I continue to hold on the assumption that this is consolidation, not a turnaround.

Saturday, June 06, 2009

Keep rolling the dice

I spent Friday away from the computer, so I was unable to trade all day. I managed to check the pre-market action and adjust my stops, then tried not to worry the rest of the day. When I got back I saw that no stops were triggered, so my 5 holdings still exist. Here's the update:

ABAT

Is still creeping up the triangle support. I have two lines of resistance, the triangle peak at 4.10, and a Fibonacci peak at 3.99. On the other hand, I'm worried that this triangle has gone on too long and will fail. I'll be keeping my stops based on the Fib numbers.

AGO

Is trucking along an upward channel, and just popped through resistance. Fib numbers have a target of 21.14, and the channel says we won't get there before July 7. I'm keeping an eye on volume to see if it keeps up through this rally.

CSE

Tested resistance again today, but failed. Stop is based on Fib numbers, and the Fib target is at 6.12. I'm getting worried about this one.

ILMN

Continues to test my patience, but it's starting to look like a short-term flag for the resistance penetration. That resistance is now support, and being tested repeatedly. I'm starting to relax a little more on this one, and Fib target is at 41.82, but the channel won't let that happen until August. There's always a bump-&-run pattern to boost it quickly.

STKL

Resistance around 2.24, and there's a really strong long-term target of 4.30. Long-term here means no sooner than August.

I'll also be looking into getting into OSCI, among a few others. But OSCI is less than a dollar, and volume is going nuts, so I'm going to see what I can do with it.

(image from thestockmasters.com)

Thursday, June 04, 2009

Short-Term Wins

I made 5 buys yesterday, and they made me 5.75% today.

STKL @ 1.84

It paid off nicely today; I see next resistance around 2.08, and later at 2.30. Today's close was up on light volume, and I'm pretty sure that's a good sign of continuation.

ILMN @ 39.54

I had been watching this stock for weeks from a tip by RevShark, when it was nearing 38.50 for the second or third time. After failing to break resistance and drawing out for a bit longer, I was ready to let this one drop. But then it shot through resistance and grabbed my attention. I made the sucker-buy, right at the peak of the day. It's still holding support and looks like a nice pennant, so I'm holding for now.

CSE @ 3.82

Moved up nicely today, as well, following the Ascending Triangle pattern towards resistance at 4.30. It looks good to break through, but if it drops to 4.00 first, I'm afraid it might fail (see the headfake by ILMN above).

AGO @ 14.24

Broke though a recent resistance level of 14.61 and kept on trucking. It finished the day in consolidation, but I don't see any reason for it to turn around in a big way anytime soon.

ABAT @ 3.69

This one is really stretching out it's shape, and I wonder if that is the sign of a breakdown. I see several signs of weakness, but this may still just be a prolonged consolidation period. It's not in this chart, but I also see a flat channel of 3.37-4.00, and today's close tested the midrange of that channel. I've placed my stops based on the channel, not the triangle.

Thanks to WeeklyTA and Trader Stewie for tipping me to a couple of these winners. The others I found using ThinkOrSwim's Pattern finder.

STKL @ 1.84

It paid off nicely today; I see next resistance around 2.08, and later at 2.30. Today's close was up on light volume, and I'm pretty sure that's a good sign of continuation.

ILMN @ 39.54

I had been watching this stock for weeks from a tip by RevShark, when it was nearing 38.50 for the second or third time. After failing to break resistance and drawing out for a bit longer, I was ready to let this one drop. But then it shot through resistance and grabbed my attention. I made the sucker-buy, right at the peak of the day. It's still holding support and looks like a nice pennant, so I'm holding for now.

CSE @ 3.82

Moved up nicely today, as well, following the Ascending Triangle pattern towards resistance at 4.30. It looks good to break through, but if it drops to 4.00 first, I'm afraid it might fail (see the headfake by ILMN above).

AGO @ 14.24

Broke though a recent resistance level of 14.61 and kept on trucking. It finished the day in consolidation, but I don't see any reason for it to turn around in a big way anytime soon.

ABAT @ 3.69

This one is really stretching out it's shape, and I wonder if that is the sign of a breakdown. I see several signs of weakness, but this may still just be a prolonged consolidation period. It's not in this chart, but I also see a flat channel of 3.37-4.00, and today's close tested the midrange of that channel. I've placed my stops based on the channel, not the triangle.

Thanks to WeeklyTA and Trader Stewie for tipping me to a couple of these winners. The others I found using ThinkOrSwim's Pattern finder.

Wednesday, June 03, 2009

I hate it when work gets in the way of my trading

Been busy with the full-time job, so I've been inactive in the markets this past week. Despite all my pessimism since March, I'm finally starting to accept that this rally could continue. I don't see another pivot point for the S&P 500 until about 1014. Here's what I'm watching:

I expect STKL to hover around the 1.84 level all day Wednesday, where it should hit upward support (not shown). I'm going to watch it today for a long opportunity.

ASCA looks like it's forming an Ascending Triangle, but I'm a buyer in two conditions: if it bounces off support around 19.25, or if it breaks resistance around 23.34. Gotta watch out in case this turns into a Double Top pattern.

ABAT is a similar case, Ascending Triangle near it's tip.

I also like to watch the 30-yr Treasury Bonds, ever since I sold mine a short while back. Now that Direxion has a triple ETF for it, I'll be looking to play the T-Bonds through TMV/TMF. I'm long-term bearish the 30-yr, so TMV is my favorite. I might ride TMF down until $TYX hits 44, and then see if support is broken again.

I expect STKL to hover around the 1.84 level all day Wednesday, where it should hit upward support (not shown). I'm going to watch it today for a long opportunity.

ASCA looks like it's forming an Ascending Triangle, but I'm a buyer in two conditions: if it bounces off support around 19.25, or if it breaks resistance around 23.34. Gotta watch out in case this turns into a Double Top pattern.

ABAT is a similar case, Ascending Triangle near it's tip.

I also like to watch the 30-yr Treasury Bonds, ever since I sold mine a short while back. Now that Direxion has a triple ETF for it, I'll be looking to play the T-Bonds through TMV/TMF. I'm long-term bearish the 30-yr, so TMV is my favorite. I might ride TMF down until $TYX hits 44, and then see if support is broken again.

Subscribe to:

Posts (Atom)