I have mentioned that I've heard rumors of how Goldman Sachs could be controlling the markets these days. No, I didn't get it from GoldmanSachs666.com, never actually been to the site...yet. I've heard mention of this from several different sources, but a recent article by Zero Hedge explains a lot. So much that I had to read it 2 or 3 times to digest all the big, hard words like "Pricipal Trader," which means trading not on behalf of its clients but for its own benefit. Here's some highlights from the posting:

"...Goldman has seen its share of Principal trading go from 60% all the way into 90%: a vast majority of all its trades are merely for its own benefit (and potentially as an SLP funnel)."

NOTE: read the article for a definition of SLP, it's the point of the whole post.

"...while the total amount of total Principal trading as a portion of NYSE PT has stayed relatively flat, at about half of total PT volumes, Goldman's share has exploded over the past six months: while GS was responsible for around 27% of Principal NYSE stock trading in Q3 and most of Q4, that number has risen to the low 50% range over the past 3 months."

"...traditional market neutral, high-frequency quants, aka independent liquidity providers have not only suffered significant P&L losses in April, but have deleveraged to a point where their presence in the market is negligible, resulting in dramatic volatility spikes on low volume. Could it be that Goldman is singlehandedly benefitting from being the liquidity provider of last resort, even more so as there are virtually no other participants in the SLP program? And, as is expected, with a liquidity "monopoly", come unprecedented opportunities to take advantage of this, depending on one's view of the market."

Thanks to

Saturday, May 02, 2009

Friday, May 01, 2009

FAS update, 3:29 pm

Thursday, April 30, 2009

Speculate This!

Thanks to Evil Speculator for explaining the rules for bear markets and bear market rallies:

I also discovered another conspiracy theory: that the bank stocks have been going up so that the bankers can have some equity to back up their lending and other witchcraft. I think it's rather that the $750B Christmas Bonus given to them by Congress is being realized in the stock price, and not the other way around. The banks have all this money for lending, but they're using it instead to keep the employees (at the top) happy and to save for a rainy day. However, it's been raining for over a year, and the housing, mortgage, and forclosure notice numbers all seem to suggest that the storm is only getting worse. I'm sure this bank fiasco will all make sense 3 years from now when we look back and the truth is slowly leaked out in the back pages of the 2 or 3 newspapers still printing on real paper.

Other talk is that the Market Makers are whipsawing the prices and destroying the average/noob trader's equity accounts like a whipsaw through a noob trader's account, and that there's not much volume otherwise. I've been hearing for almost 2 years now that the "money is on the sidelines", people are waiting for the chance to jump in. Supposedly, only the institutions are trading, and so the volume is low. I don't know about that. I'm not sure what institutional volume is supposed to look like, but the volume levels on my charts look nominal. It's all noise, the real trading needs to be based on the charts and nothing else.

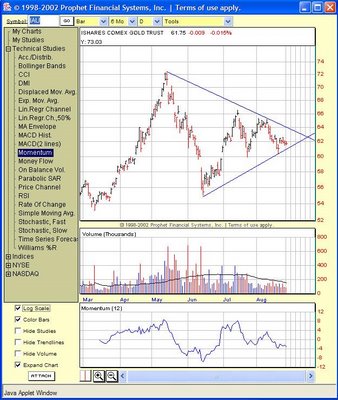

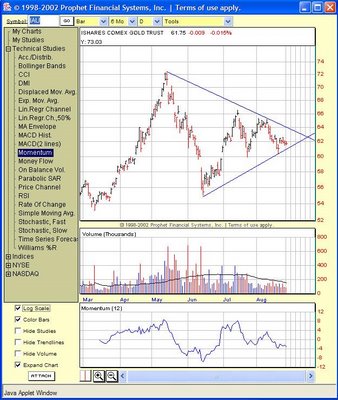

As for charts, thanks to Trader Stewie for pointing out this winner. He's got a new stock alert service with a free trial. I'm trading with my IRA, so I can't touch any money for another 30 years, and the rest of my paycheck goes to one of those big banks that got billions in bailout money... I guess that means my paycheck AND my tax money go there..hmmmm. Anyway, I'd like to sign up for his service as soon as I can make trading a more serious hobby...or job. I'd definitely recommend it!

As for charts, thanks to Trader Stewie for pointing out this winner. He's got a new stock alert service with a free trial. I'm trading with my IRA, so I can't touch any money for another 30 years, and the rest of my paycheck goes to one of those big banks that got billions in bailout money... I guess that means my paycheck AND my tax money go there..hmmmm. Anyway, I'd like to sign up for his service as soon as I can make trading a more serious hobby...or job. I'd definitely recommend it!

XLF is showing an ascending triangle pattern. As much as I am still pessimistic about the banks, this chart is telling me that XLF is about to pop up again...long live the banks/financials. I'll be looking for a pullback in FAS to get in.

Update on previous holdings: I got into TNA today and was almost instantly stopped out as it kept falling. I got into my bear short, TMV, and it's looking good so far. This is despite the Fed announcing that it will buy back another $300B in treasuries by autumn. I had expected a correction, but it was short-lived as I have seen the wildest interday spikes in 30-yr treasury rates ever in the 4+ years I've been watching them.

Still holding GM and GSI in the green.

Bear market rallies continue on bad news and reverse on good news.Chrysler is filing for bankruptcy. Normally, that is bad news... but my GM stock went up in sympathy. Uhhhhhhhh, Y-e-e-e-e-a-a-a-a-h-h-h...

I also discovered another conspiracy theory: that the bank stocks have been going up so that the bankers can have some equity to back up their lending and other witchcraft. I think it's rather that the $750B Christmas Bonus given to them by Congress is being realized in the stock price, and not the other way around. The banks have all this money for lending, but they're using it instead to keep the employees (at the top) happy and to save for a rainy day. However, it's been raining for over a year, and the housing, mortgage, and forclosure notice numbers all seem to suggest that the storm is only getting worse. I'm sure this bank fiasco will all make sense 3 years from now when we look back and the truth is slowly leaked out in the back pages of the 2 or 3 newspapers still printing on real paper.

Other talk is that the Market Makers are whipsawing the prices and destroying the average/noob trader's equity accounts like a whipsaw through a noob trader's account, and that there's not much volume otherwise. I've been hearing for almost 2 years now that the "money is on the sidelines", people are waiting for the chance to jump in. Supposedly, only the institutions are trading, and so the volume is low. I don't know about that. I'm not sure what institutional volume is supposed to look like, but the volume levels on my charts look nominal. It's all noise, the real trading needs to be based on the charts and nothing else.

As for charts, thanks to Trader Stewie for pointing out this winner. He's got a new stock alert service with a free trial. I'm trading with my IRA, so I can't touch any money for another 30 years, and the rest of my paycheck goes to one of those big banks that got billions in bailout money... I guess that means my paycheck AND my tax money go there..hmmmm. Anyway, I'd like to sign up for his service as soon as I can make trading a more serious hobby...or job. I'd definitely recommend it!

As for charts, thanks to Trader Stewie for pointing out this winner. He's got a new stock alert service with a free trial. I'm trading with my IRA, so I can't touch any money for another 30 years, and the rest of my paycheck goes to one of those big banks that got billions in bailout money... I guess that means my paycheck AND my tax money go there..hmmmm. Anyway, I'd like to sign up for his service as soon as I can make trading a more serious hobby...or job. I'd definitely recommend it!XLF is showing an ascending triangle pattern. As much as I am still pessimistic about the banks, this chart is telling me that XLF is about to pop up again...long live the banks/financials. I'll be looking for a pullback in FAS to get in.

Update on previous holdings: I got into TNA today and was almost instantly stopped out as it kept falling. I got into my bear short, TMV, and it's looking good so far. This is despite the Fed announcing that it will buy back another $300B in treasuries by autumn. I had expected a correction, but it was short-lived as I have seen the wildest interday spikes in 30-yr treasury rates ever in the 4+ years I've been watching them.

Still holding GM and GSI in the green.

Tuesday, April 28, 2009

The name's Bond, Junk Bond...

The smartest thing I've done this week is dump my 30-yr treasuries that I've held for 4 years. The dumbest thing I'm probably going to do is go nuts against those bonds further by putting some of that newly-freed cash into a 3x ETF going against those same bonds: TMV. If the banks won't give me what I want, then perhaps TMV will...

Still holding FAZ overnight for small gain as of now, but that ETF is so volatile right now that I'm not getting excited yet. Dropped LVLT today, it was rockin' yesterday but stopped me out today. If this keeps up, I'll get out of SIRI too. GSI and GM disappointed today, but still within tolerance.

Many indices are completing wedge patterns, indicating a substantial move in either direction soon. The fundamentals still point to doom, but there is just no telling at this point. Chances are, when the wedge is broken, a lot of traders while pile in. Gotta be quick!

Wednesday, I'll be watching TMV, TNA, and TZA for entries.

Still holding FAZ overnight for small gain as of now, but that ETF is so volatile right now that I'm not getting excited yet. Dropped LVLT today, it was rockin' yesterday but stopped me out today. If this keeps up, I'll get out of SIRI too. GSI and GM disappointed today, but still within tolerance.

Many indices are completing wedge patterns, indicating a substantial move in either direction soon. The fundamentals still point to doom, but there is just no telling at this point. Chances are, when the wedge is broken, a lot of traders while pile in. Gotta be quick!

Wednesday, I'll be watching TMV, TNA, and TZA for entries.

Monday, April 27, 2009

Krispey, yet Kremey

I learned a new term today: 'stop sweep'. KKD opened up and then spiked-down big time this morning. It dropped just enough to kiss my stop, and then shot back up. More market f*ckery by the Market Makers, I assume. They've learned a new trick: sell sell sell to kick out all the preset stops placed out there, then flip the price back up and get the suckers to jump back in.

KKD is almost back down to where it stopped me out, and I haven't been eager get back in. Too much Krispey Kreme gives me heartburn, anyway.

Speaking of heartburn, the Fed should look into acquiring Waste Management while it assumes all this garbage it's taking from the banks. There is a massive transfer of wealth...correction: there WAS a massive transfer of wealth. The banks/lenders gave all the money to the developers/speculators/insurers/etc..., and now we taxpayers are transferring it back to the banks through the FED. It's going to get worse before it gets worse.

KKD is almost back down to where it stopped me out, and I haven't been eager get back in. Too much Krispey Kreme gives me heartburn, anyway.

Speaking of heartburn, the Fed should look into acquiring Waste Management while it assumes all this garbage it's taking from the banks. There is a massive transfer of wealth...correction: there WAS a massive transfer of wealth. The banks/lenders gave all the money to the developers/speculators/insurers/etc..., and now we taxpayers are transferring it back to the banks through the FED. It's going to get worse before it gets worse.

Daytrading, the next fad?

I'm finding that more and more daytraders, who have been blogging and vlogging for several years now, are going "pro", they have decided to start charging for their services. They have rightfully earned their status, with a regular population of followers, so they can get away with adding the extra income. More power to you guys.

But it's an interesting sign of the times: more daytrading followers indicates that more people are looking to trade for themselves. I'm just worried that sudden growth like this could turn into fad-status, but I'm not sure what to make of it yet. Right now, we could use some more meat for the grinder, the volume has been so low these past few weeks that the big money movers (a.k.a. Market Makers) have nearly full control over what the markets are doing that day.

The only thing I can think of for now is that 401k firms and mutual funds might start having to get creative to retain investors, while this new wave of private (and unlicensed) advisors fill the holes. Interesting times, indeed.

But it's an interesting sign of the times: more daytrading followers indicates that more people are looking to trade for themselves. I'm just worried that sudden growth like this could turn into fad-status, but I'm not sure what to make of it yet. Right now, we could use some more meat for the grinder, the volume has been so low these past few weeks that the big money movers (a.k.a. Market Makers) have nearly full control over what the markets are doing that day.

The only thing I can think of for now is that 401k firms and mutual funds might start having to get creative to retain investors, while this new wave of private (and unlicensed) advisors fill the holes. Interesting times, indeed.

Friday, April 24, 2009

More Headfake

Some of the buzz I caught today is more confusion on which way the markets are going. The Bears expected a big move down today based on technicals. But volume was relatively low today, and at key points...nothing happened. So, the door was left wide open for the market movers to decide the day. And since most of THOSE guys work at the banks/financials, guess which way it went at the end of the day?

Ok, I'm starting to sound like a conspiracy theorist, it's beginning to bother me. I don't want to turn into some wacko full of crazy ideas, because such people instantly lose credibility with me. But I'm still trying to figure all this out from a newbie, retail, point of view... who's trying to stay away from the herd.

Anyway, look at the chart above. Despite the sudden move up at the end of the day, XLF (and the S&P for that matter) is still within it's nominal channel and behaving normal. There's still a ceiling around 11.50, but I've already bought some FAZ in anticipation.

If I didn't say already, here's my other holdings (all long): GM, SIRI, GSI, KKD, LVLT, and some 30-yr US bonds I got when they were around 5%. I tried dumping the bonds on Wednesday, but the buy offer expired before I accepted. I still hold them, but I'm watching the rates for a few days, looks like the prices might rise a tad again.

Thursday, April 23, 2009

Treasury Recall

Treasury Department Issues Emergency Recall Of All US Dollars

I see short-term down days ahead, but I am long a select few favorites that have been scraping bottom: KKD, SIRI, GSI, GM, and LVLT. I'm keeping an eye on all these with tight stops, along with yet another FAZ entry.

Lots of chop right now, and I'm guessing the government's Stress Test announcements are being timed to try and keep things afloat. Let's see if that and the false bank profits can keep this Market F*ckery going!

Still reading Jim Rogers A Bull in China, and building a list of Chinese stocks to research.

Saturday, April 18, 2009

Here it comes

Options expired today, and earnings are about through. All the banking information released is total bunk, yet I still don't get tired of getting burned by FAZ. Direxion triple ETF's have now earned the term, "Devil's ETFs". Now is not the time to make a deal with the Devil, but soon....soon.

S&P 500 is reaching a critical point of decision: a rising wedge starting to touch a fairly decent line of resistance. This is very Bearish, indeed, and I'm itching to short the S&P and get it out of my system.

GS has settled around the 120 mark that I suggested in my last post, and is closing the gap to the 2-yr old resistance line. The top is around 126 here, but since that line goes so far back, I'd have to keep it exact number a little fuzzy until it gets defined. It may end up being a thick line with a hi-low range, so I'm not going to worry about it. GS likes to move in the direction of the Indices, so if the Dow goes down, GS might follow. There's still some room on this ceiling, though, and I won't be surprised if it finally gets touched before any real moves down.

I'm currently reading Jim Rodger's A Bull in China. And I just so happen to keep hearing recommendations by the pros for FEED (Chinese owned). I jumped in today and got stopped out before the close. I will look to get back in around 3.00, this might be a good long-term play.

S&P 500 is reaching a critical point of decision: a rising wedge starting to touch a fairly decent line of resistance. This is very Bearish, indeed, and I'm itching to short the S&P and get it out of my system.

GS has settled around the 120 mark that I suggested in my last post, and is closing the gap to the 2-yr old resistance line. The top is around 126 here, but since that line goes so far back, I'd have to keep it exact number a little fuzzy until it gets defined. It may end up being a thick line with a hi-low range, so I'm not going to worry about it. GS likes to move in the direction of the Indices, so if the Dow goes down, GS might follow. There's still some room on this ceiling, though, and I won't be surprised if it finally gets touched before any real moves down.

I'm currently reading Jim Rodger's A Bull in China. And I just so happen to keep hearing recommendations by the pros for FEED (Chinese owned). I jumped in today and got stopped out before the close. I will look to get back in around 3.00, this might be a good long-term play.

Monday, April 13, 2009

Gold, Man!

Goldman Sachs reported earnings early today. I didn't know that because I was reading the news, I found out because the professional traders posting on the decent blogs that I frequent were posting in disbelief. I hear ("read") terms such as, "WTF?!?!", "..how brazen,", and "huh?" Apparently, is was premature for GS to announce today. Maybe they had to one-up Wells Fargo with their premature annouce-ulation Friday? WFC still hasn't actually announced earnings, they just wanted to let us all know that it's gonna be great!

Whew, what a relief! This rally is up almost 29% in A MONTH, but we needed that warm, maternal, reassurance of STELLAR earnings by these financial groups right away. Heaven forbid that this rally loses thrust while still trying to break orbit! I must applaud PresBO, the Fed, the Treasury, and all these Wall Street clubbers for the machine-like execution of their joint effort in keeping things afloat. It is working very well right now, and yet I can't seem to stay away from listening to Jim Rogers or this guy:

That being said, here's the technicals on GS:

Price action is attempting to penetrate a 1.5 year old resistance line that sits around 128-132 today. Breaking through that channel is quite bullish, and I'd expect to see it go up for at least a couple of days before any red candles form.

But the Bear in me loves the dark, dismal side! MACD is looking tired, just like it did back in December (see arrows), and there may be a trend to follow the wedge. Since I don't have the fancy charts that light up the price on the right, I had to mouse over the point of convergence for the three lines, I got April 23 at $125.71. If GS just doesn't take off the next few days, we could see a pennant before the rally continues. Makes a good case to get in GS around $120. Even StockTA.com has nothing but support for GS!

Whew, what a relief! This rally is up almost 29% in A MONTH, but we needed that warm, maternal, reassurance of STELLAR earnings by these financial groups right away. Heaven forbid that this rally loses thrust while still trying to break orbit! I must applaud PresBO, the Fed, the Treasury, and all these Wall Street clubbers for the machine-like execution of their joint effort in keeping things afloat. It is working very well right now, and yet I can't seem to stay away from listening to Jim Rogers or this guy:

That being said, here's the technicals on GS:

Price action is attempting to penetrate a 1.5 year old resistance line that sits around 128-132 today. Breaking through that channel is quite bullish, and I'd expect to see it go up for at least a couple of days before any red candles form.

But the Bear in me loves the dark, dismal side! MACD is looking tired, just like it did back in December (see arrows), and there may be a trend to follow the wedge. Since I don't have the fancy charts that light up the price on the right, I had to mouse over the point of convergence for the three lines, I got April 23 at $125.71. If GS just doesn't take off the next few days, we could see a pennant before the rally continues. Makes a good case to get in GS around $120. Even StockTA.com has nothing but support for GS!

Sunday, April 12, 2009

There will be blood!

Thanks to Evil Speculator for this cry of doom & gloom, here at the peak of this Bear Market Rally.

Things have been going well, and the charts look like we're piercing through resistance lines left and right. But I still can't stop feeling that this whole rally is artificial, and it just won't be enough to float us until the fundamentals catch up. Creeping inflation is still hitting us while the FED denies it through "Core CPI", we've printed more money than EVER to bail ourselves out, and we now have a bunch of financial institutions who are technically government owned.

Over Easter, I spoke with my sister-in-law, who is a manager at a big bank. She says that the TARP funds were originally going to have to be held by the banks for a minimum of 3 years while they paid interest to the gov't, but now it's down to 1 year minimum. They still have to pay that interest, and were forced to take the loans by the government. Bailout or not, I don't care what they say or how much we're mad at the banks, but the Feds scammed the banks for some guaranteed interest payments while telling the rest of us that it was for our own good. Why can't politicians just come right out and say what they're really doing? Is it so bad to dance around these feel-good explanations instead of just telling us what's going on? Are we, the people, that ignorant? Probably so, so I'll just stop that rant right there.

But this particular bank can't wait to pay back it's TARP money (which every single bank in the country had to take, big or small), and thinks it will be rockin' in a year, especially when it's acquisition comes through of another major financial firm with big-hitter money management accounts. In a related note, Goldman Sachs wants to dump $5.5B of itself into a fresh stock offering so that it can pay off its TARP money NOW!

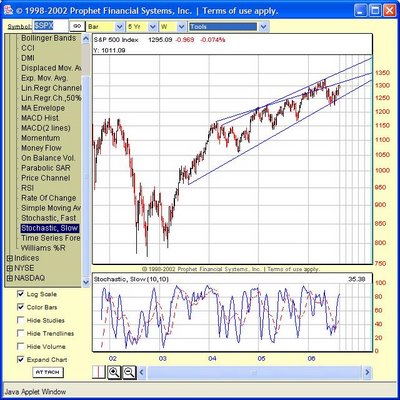

So, the banks are optimistic. The bulls are optimistic. The charts are even looking optimistic. Look how a the S&P continues to channel up through repeted declining RSI and MACD curves:

But with all these gaps up and down overnight, retailers like me are taking a step back after getting burned a few times. This bull looks like it could keep going, but it's also looking pretty tired. Earnings come out this week, Wells Fargo put the market into a Second Stage booster lift through premature annouce-ulation. Did they really need to do that, or was the market losing steam too early?

In snort, I am so cynical about this market and rally. It's still way too choppy, and I suspect we may see more blood & chop up to about S&P 880 (max) before a serious, more prolonged "correction."

Things have been going well, and the charts look like we're piercing through resistance lines left and right. But I still can't stop feeling that this whole rally is artificial, and it just won't be enough to float us until the fundamentals catch up. Creeping inflation is still hitting us while the FED denies it through "Core CPI", we've printed more money than EVER to bail ourselves out, and we now have a bunch of financial institutions who are technically government owned.

Over Easter, I spoke with my sister-in-law, who is a manager at a big bank. She says that the TARP funds were originally going to have to be held by the banks for a minimum of 3 years while they paid interest to the gov't, but now it's down to 1 year minimum. They still have to pay that interest, and were forced to take the loans by the government. Bailout or not, I don't care what they say or how much we're mad at the banks, but the Feds scammed the banks for some guaranteed interest payments while telling the rest of us that it was for our own good. Why can't politicians just come right out and say what they're really doing? Is it so bad to dance around these feel-good explanations instead of just telling us what's going on? Are we, the people, that ignorant? Probably so, so I'll just stop that rant right there.

But this particular bank can't wait to pay back it's TARP money (which every single bank in the country had to take, big or small), and thinks it will be rockin' in a year, especially when it's acquisition comes through of another major financial firm with big-hitter money management accounts. In a related note, Goldman Sachs wants to dump $5.5B of itself into a fresh stock offering so that it can pay off its TARP money NOW!

So, the banks are optimistic. The bulls are optimistic. The charts are even looking optimistic. Look how a the S&P continues to channel up through repeted declining RSI and MACD curves:

But with all these gaps up and down overnight, retailers like me are taking a step back after getting burned a few times. This bull looks like it could keep going, but it's also looking pretty tired. Earnings come out this week, Wells Fargo put the market into a Second Stage booster lift through premature annouce-ulation. Did they really need to do that, or was the market losing steam too early?

In snort, I am so cynical about this market and rally. It's still way too choppy, and I suspect we may see more blood & chop up to about S&P 880 (max) before a serious, more prolonged "correction."

Wednesday, April 08, 2009

Where do we go now?

This is what I'm looking at tonight:

Yes, yes, very busy, so, let me explain.

I divided the chart into four segments, based on where the MACD lines crossed (Orange circles, boxes, and vertical lines). I placed a mess of trendlines to see if there were any correlations between the various indicators and price action.

The easy thing to spot is where the market bottomed in early March. Leading indicators were the positive divergence in the RSI, MACD trend & histogram, and Force Index. All those went flat while the market still dropped, until the market shot up.

I was actually hoping to find some good revelations on MA/EMA relationships, like if the MA(10) crosses the EMA(12) then I get a good buy/sell signal. I've stared at it for about 1/2 an hour now, and I don't see any indicators here. I got the idea of mixing MA with EMA from dshort.com (excellent site).

But the point of all this is in the subject of this post: Where do we go now? Well, what I see is a flat RSI and MACD curve, downtrending MACD histogram and Force Index while the price has been channeling up. Since RSI is within normal levels, I don't give it much heed. But I do have a little more confidence in the MACD flattop. That negative divergence could be a telltale sign that this rally may be coming to a close, and Trader Stewie believes we might be setting up for an upslope Head & Shoulders pattern. I'm just a little skeptical about going bearish again already, especially since the VIX is testing support levels.

I still believe that we are going to challenge the March low of 666. We might not go that far, or we could even drop to 600 (or 480!). But this rally is so unnatural (I might go into my conspiracy theories another time) that it's best to stay light-footed and be able to get in and out quickly.

Yes, yes, very busy, so, let me explain.

I divided the chart into four segments, based on where the MACD lines crossed (Orange circles, boxes, and vertical lines). I placed a mess of trendlines to see if there were any correlations between the various indicators and price action.

The easy thing to spot is where the market bottomed in early March. Leading indicators were the positive divergence in the RSI, MACD trend & histogram, and Force Index. All those went flat while the market still dropped, until the market shot up.

I was actually hoping to find some good revelations on MA/EMA relationships, like if the MA(10) crosses the EMA(12) then I get a good buy/sell signal. I've stared at it for about 1/2 an hour now, and I don't see any indicators here. I got the idea of mixing MA with EMA from dshort.com (excellent site).

But the point of all this is in the subject of this post: Where do we go now? Well, what I see is a flat RSI and MACD curve, downtrending MACD histogram and Force Index while the price has been channeling up. Since RSI is within normal levels, I don't give it much heed. But I do have a little more confidence in the MACD flattop. That negative divergence could be a telltale sign that this rally may be coming to a close, and Trader Stewie believes we might be setting up for an upslope Head & Shoulders pattern. I'm just a little skeptical about going bearish again already, especially since the VIX is testing support levels.

I still believe that we are going to challenge the March low of 666. We might not go that far, or we could even drop to 600 (or 480!). But this rally is so unnatural (I might go into my conspiracy theories another time) that it's best to stay light-footed and be able to get in and out quickly.

Saturday, April 04, 2009

Looking Down into the Geyser

Ever since the bottom, I have been bearish. This is why I'm my own, best contrarian indicator. I am so sick of this rally because I see no logical reason behind it. This rally feels like a bottom because of the relentless recovery, and yet I am very cynical about the efforts being made by the decision makers (both public and private) to turn the economy around.

The technicals point to this rally continuing into next week, but the fundamentals suggest that this is a purely emotional rally. Actually, I'm afraid it may be artificial: where is all that money that was given to the banks? Congress can't seem to get an answer, and yet the banks get a pass while GM is getting raked over the coals. I guess there is a slight difference, I have a GM product sitting in my driveway, but a bank collects monthly for the mortgage on that driveway. I work on my own car and avoid dealers like a TB ward, so GM got my money back in 2001 and won't see any more for a while.

Still, what ARE the banks doing with all that money? Paying their own loans, sitting in cash? Banks make money by investing, and many have large trading floors that move a LOT of money daily. I'm not one for conspiracy theories, but who's to say that the banks aren't quietly buying back their own stock, as financials have led this rally? Again, I don't like crackpot theories, but $760 B into financials for 3 strait weeks WOULD explain a lot, like why Congress is giving them a pass (because THEY KNOW). I'm just saying...

So, I still have much difficulty believing in this rally, which has made me "too smart" to read the Trend. Therefore, I have been staring down into the flow of this geyser as it has blasted me in the face. This week, I've listened to a parade of economists on Bloomberg Surveillance predicting lower lows in 3rd QTR 2009...oops, just heard one say 2nd QTR, before we go back up.

This rally is tired. Remember that the trend is your friend, and don't try to outsmart the technicals. Last week's technicals are showing bullish ascending wedges and pennants, XLF looks like a flag. This is all bullish, but I get more skeptical every day.

The technicals point to this rally continuing into next week, but the fundamentals suggest that this is a purely emotional rally. Actually, I'm afraid it may be artificial: where is all that money that was given to the banks? Congress can't seem to get an answer, and yet the banks get a pass while GM is getting raked over the coals. I guess there is a slight difference, I have a GM product sitting in my driveway, but a bank collects monthly for the mortgage on that driveway. I work on my own car and avoid dealers like a TB ward, so GM got my money back in 2001 and won't see any more for a while.

Still, what ARE the banks doing with all that money? Paying their own loans, sitting in cash? Banks make money by investing, and many have large trading floors that move a LOT of money daily. I'm not one for conspiracy theories, but who's to say that the banks aren't quietly buying back their own stock, as financials have led this rally? Again, I don't like crackpot theories, but $760 B into financials for 3 strait weeks WOULD explain a lot, like why Congress is giving them a pass (because THEY KNOW). I'm just saying...

So, I still have much difficulty believing in this rally, which has made me "too smart" to read the Trend. Therefore, I have been staring down into the flow of this geyser as it has blasted me in the face. This week, I've listened to a parade of economists on Bloomberg Surveillance predicting lower lows in 3rd QTR 2009...oops, just heard one say 2nd QTR, before we go back up.

This rally is tired. Remember that the trend is your friend, and don't try to outsmart the technicals. Last week's technicals are showing bullish ascending wedges and pennants, XLF looks like a flag. This is all bullish, but I get more skeptical every day.

Sunday, March 29, 2009

Long Term Analysis

Haven't even looked at the market since Wednesday. I've had problems with my dog, and then with my grandmother out of town. I've missed all this churn for the past week, thankfully.

We can see a bullish, rising wedge forming for over a week now. It appears that XLF may be falling through support, but it's still within tolerance, and the aftermarket moved back up to 9.19. This pattern should break Monday or Tuesday. I've reached boredom with looking for a reversal, so I'll be looking at FAS. However, since I'm a pretty good contrarian indicator, I'll just keep an eye on XLF and get ready to go either way, FAS/FAZ. Recent narrowing of the channel has reduced volatility of the financials, and I've seen traders (the smart ones) moving into pure equities (not the ETF's) to get bigger profits. After enough people get bored with XLF, there may be good opportunity for a big move when this bullish wedge breaks.

As for where this market is going to go, this rally has really felt like "the bottom." But I still have serious doubts. Recent news about Tobin's Q-Ratio has apparently gone out to the CFA's of the country, as I've heard several of them talk about it recently. One of them is Steve Pomeranz, to whom I listen every week. Here's another CFA who explains Q-Ratio and where it is today. Mr. Pomeranz, by the way, states that the Q-Ratio during 1932 was around 0.30 (& 1921, 1949, & 1952), today it's at 0.76. He also quotes an analyst who believes we'll be in a rally for 2 years supported by the Stimulus until it wears off, and then we'll see things drop to 0.30 by 2014. Congress has been known to extend laws dealing with money, so I'm not too sure about this analysis. But a decent, 2-3 year rally could compare with the the roller coaster ride of 1965-1977. Listen to his radio show from March 23, 2009. He explains all this in the first 7 minutes.

Long term, this looks like a Bear Market Rally that will remain relatively flat for a few months, churning around to look like a wide, dome shape. This rally is being floated by all the stimulus getting pumped into the system by the Fed and Congress with borrowed money. I don't think this jump-start is enough, the fire needs to be put out at the source, and there's not enough fire trucks. This thing is world-wide, and repercussions are still rippling around across the oceans. There is still a lot of room to fall, and I don't see that the fundamentals have really changed enough to turn things around...yet.

Also, here is a monthly chart of the S&P 500 since 1928, log scale. Look at the very right side, 1999-present. I'm concerned about the negative divergence between the double tops and the MACD & RSI peaks down below. Not a good sign...

We can see a bullish, rising wedge forming for over a week now. It appears that XLF may be falling through support, but it's still within tolerance, and the aftermarket moved back up to 9.19. This pattern should break Monday or Tuesday. I've reached boredom with looking for a reversal, so I'll be looking at FAS. However, since I'm a pretty good contrarian indicator, I'll just keep an eye on XLF and get ready to go either way, FAS/FAZ. Recent narrowing of the channel has reduced volatility of the financials, and I've seen traders (the smart ones) moving into pure equities (not the ETF's) to get bigger profits. After enough people get bored with XLF, there may be good opportunity for a big move when this bullish wedge breaks.

As for where this market is going to go, this rally has really felt like "the bottom." But I still have serious doubts. Recent news about Tobin's Q-Ratio has apparently gone out to the CFA's of the country, as I've heard several of them talk about it recently. One of them is Steve Pomeranz, to whom I listen every week. Here's another CFA who explains Q-Ratio and where it is today. Mr. Pomeranz, by the way, states that the Q-Ratio during 1932 was around 0.30 (& 1921, 1949, & 1952), today it's at 0.76. He also quotes an analyst who believes we'll be in a rally for 2 years supported by the Stimulus until it wears off, and then we'll see things drop to 0.30 by 2014. Congress has been known to extend laws dealing with money, so I'm not too sure about this analysis. But a decent, 2-3 year rally could compare with the the roller coaster ride of 1965-1977. Listen to his radio show from March 23, 2009. He explains all this in the first 7 minutes.

Long term, this looks like a Bear Market Rally that will remain relatively flat for a few months, churning around to look like a wide, dome shape. This rally is being floated by all the stimulus getting pumped into the system by the Fed and Congress with borrowed money. I don't think this jump-start is enough, the fire needs to be put out at the source, and there's not enough fire trucks. This thing is world-wide, and repercussions are still rippling around across the oceans. There is still a lot of room to fall, and I don't see that the fundamentals have really changed enough to turn things around...yet.

Also, here is a monthly chart of the S&P 500 since 1928, log scale. Look at the very right side, 1999-present. I'm concerned about the negative divergence between the double tops and the MACD & RSI peaks down below. Not a good sign...

Tuesday, March 24, 2009

And Now for Something Completely Different...

Hey guys! I just found this cool, new thing! It's called, Moving Averages!!! It's SOOOOOO cool!

Ok, seriously. I've been placing EMA's in my charts for years, now, but never really used them. I just put them there because some big-shot money-makin trader told me to a while back. Now, thanks to dshort.com, I've realized a little better how to use them to time entries and exits. Also, checkout iBankCoin.com for true, expert knowledge.

I've put up a 10-MA and 12-EMA on my charts and started browsing around. Visual back-testing has helped me come up with a few clues on how to use them, so I'll be trying it out in the near future.

With that in mind, I think I am ready to call a local top to this rally. XLF is breaking down, and I'll be looking to get back into FAZ tomorrow after the morning pop (Stewie, are you reading?).

20 Day XLF. I see a Megaphone Pattern expanding for a week now, combined with declining trends in MACD and RSI. Blue EMA curve is also leading a bearish sign, and I'll be looking for confirmation after tomorrow's opening.

5 Day XLF. I'll be watching for price to not penetrate the Blue EMA line, and for that line to lead a decline. There's a good chance that XLF will break through the channel support around 8.75.

Ok, seriously. I've been placing EMA's in my charts for years, now, but never really used them. I just put them there because some big-shot money-makin trader told me to a while back. Now, thanks to dshort.com, I've realized a little better how to use them to time entries and exits. Also, checkout iBankCoin.com for true, expert knowledge.

I've put up a 10-MA and 12-EMA on my charts and started browsing around. Visual back-testing has helped me come up with a few clues on how to use them, so I'll be trying it out in the near future.

With that in mind, I think I am ready to call a local top to this rally. XLF is breaking down, and I'll be looking to get back into FAZ tomorrow after the morning pop (Stewie, are you reading?).

20 Day XLF. I see a Megaphone Pattern expanding for a week now, combined with declining trends in MACD and RSI. Blue EMA curve is also leading a bearish sign, and I'll be looking for confirmation after tomorrow's opening.

5 Day XLF. I'll be watching for price to not penetrate the Blue EMA line, and for that line to lead a decline. There's a good chance that XLF will break through the channel support around 8.75.

Thursday, March 19, 2009

Well class, what did we learn?

Never, EVER, stand in the way of a trend for so long. I broke all the rules, bet too much, pulled the stops, and denied losses in an emotional fury.

So, where do we go from here? Markets finally pulled back from this week-long, insane rally today, but there is SO much conflicting information to try to figure out a trend right now.

1) Financials have led the rally, possibly because they reported better earnings this week. But, has the situation really improved?

2) Ben Bernanke, and the FOMC have both made announcements this week that appear crafted to jump-start the market. And while the Fed announcement to buy back 30-yr treasuries sounds like a good thing, they're going to have to print money to do it. This will cause inflation, the Fed's bane.

3) President Obama is going to be on TV tonight. I expect he will change from his "doom & gloom" speech to "roses and butterflies are coming soon".

4) There are a lot of bloggers talking about going short during the week, only to have become quickly squeezed out.

5) There's new offerings sponsored by the government help resolve housing problems, get/keep people in houses, slow/stop foreclosures, and find new ways to deal with all the bad loans out there.

6) Half the traders out there are saying that we still have months of more downside to go, or would that be just sideways chop? And I'm hearing more doom & gloom into this rally. One stated, "if this really was the bottom, then we wouldn't be asking ourselves right now if this was the bottom." THE BOTTOM is typically characterized by so much despair that people have given up on looking for a recovery.

It all just seems too easy at this point. Some want to compare this to The Great Depression, but the markets haven't really behaved the same. To match the Depression, the Dow would need to fall another 4952 points from today's close of 7400, to bottom at DOW 1846. I think we're due for a pullback, but I expect a short one for now before the rally continues to, at least, 825-850 SPX.

Then again, perhaps all this news is really just noise. Look at the charts and turn off CNBC! I just can't stop the feeling that we'll have a higher low during this consolidation, followed by more rally. Then, we might see another HUGE drop in a month or two.

****UPDATE:

I just noticed that how today's volume compared in the Bullish ETFs to the Bearish ETFs. FAS had almost 6x the volume of FAZ, and dropped 20% while a theoretical inverse drop in FAZ (if you reverse the open and close numbers) would have only been a 13% drop. I think it means the bulls are pulling out, but the bears aren't jumping in. I wonder if tomorrow will continue consolidation?

So, where do we go from here? Markets finally pulled back from this week-long, insane rally today, but there is SO much conflicting information to try to figure out a trend right now.

1) Financials have led the rally, possibly because they reported better earnings this week. But, has the situation really improved?

2) Ben Bernanke, and the FOMC have both made announcements this week that appear crafted to jump-start the market. And while the Fed announcement to buy back 30-yr treasuries sounds like a good thing, they're going to have to print money to do it. This will cause inflation, the Fed's bane.

3) President Obama is going to be on TV tonight. I expect he will change from his "doom & gloom" speech to "roses and butterflies are coming soon".

4) There are a lot of bloggers talking about going short during the week, only to have become quickly squeezed out.

5) There's new offerings sponsored by the government help resolve housing problems, get/keep people in houses, slow/stop foreclosures, and find new ways to deal with all the bad loans out there.

6) Half the traders out there are saying that we still have months of more downside to go, or would that be just sideways chop? And I'm hearing more doom & gloom into this rally. One stated, "if this really was the bottom, then we wouldn't be asking ourselves right now if this was the bottom." THE BOTTOM is typically characterized by so much despair that people have given up on looking for a recovery.

It all just seems too easy at this point. Some want to compare this to The Great Depression, but the markets haven't really behaved the same. To match the Depression, the Dow would need to fall another 4952 points from today's close of 7400, to bottom at DOW 1846. I think we're due for a pullback, but I expect a short one for now before the rally continues to, at least, 825-850 SPX.

Then again, perhaps all this news is really just noise. Look at the charts and turn off CNBC! I just can't stop the feeling that we'll have a higher low during this consolidation, followed by more rally. Then, we might see another HUGE drop in a month or two.

****UPDATE:

I just noticed that how today's volume compared in the Bullish ETFs to the Bearish ETFs. FAS had almost 6x the volume of FAZ, and dropped 20% while a theoretical inverse drop in FAZ (if you reverse the open and close numbers) would have only been a 13% drop. I think it means the bulls are pulling out, but the bears aren't jumping in. I wonder if tomorrow will continue consolidation?

Wednesday, March 18, 2009

Short Squeeze?

Today moved as predicted, although a little more pronounced than expected. I've heard a little buzz here and there that this week's price performance may be influenced by the fact that this Friday is Expiration Day for March options. I don't really understand HOW that affects stocks right now, so I hope to get more info as the week unfolds.

The rally today seemed fairly strong, especially since many traders (who blog) expected a shorting day today. After looking at the low volume, I'm thinking today was a short-squeeze play: churning out the timid bears before really going down. Of course, my opinion is biased right now. But, I DID read a comment on a blog today that theorized that since 'no one believes the rally, then there really is a rally.'

True Dat.

Monday, March 16, 2009

Hangin' in There

Still riding the FAZ for the first up-day since I got in. Volume was good for a turnaround, we'll see tomorrow. I also got a Regulation-T notice from my broker. It basically means I can't day-trade with a cash account, which is what I'm working with, unless I trade small enough to have cash on hand to settle the trades 3 days later. So, I couldn't pop out of those FAZ trades as soon as I had wanted to, anyway. Live and learn.

Stewie is nervous, he is back in FAZ at a lower entry, but has noticed ALL other bloggers are also currently short. His comments are that many of these bloggers are rookies, like myself, and that might be a bad sign.

Another trader on Trader Interviews has stated that he'll look for good ol' setups, and then trade against them, betting that the rookies will take the setup but the big fish will go the other way. There's been a lot of that these days, a lot of chop has washed out traders for a while now.

The thing that bothers me about this assumption is that MACD and EMA's are all in a different orientation. I'm not sure if that is more important, or if just the long-term to short-term line relationships are more relevant. The after-hours trades are already pointing at a head-fake, so I'm expecting higher Indices and lower FAZ tomorrow still. I predict FAZ will form a red candle with a long, lower shadow, but may not drop below today's lows.

Stewie is nervous, he is back in FAZ at a lower entry, but has noticed ALL other bloggers are also currently short. His comments are that many of these bloggers are rookies, like myself, and that might be a bad sign.

Another trader on Trader Interviews has stated that he'll look for good ol' setups, and then trade against them, betting that the rookies will take the setup but the big fish will go the other way. There's been a lot of that these days, a lot of chop has washed out traders for a while now.

The thing that bothers me about this assumption is that MACD and EMA's are all in a different orientation. I'm not sure if that is more important, or if just the long-term to short-term line relationships are more relevant. The after-hours trades are already pointing at a head-fake, so I'm expecting higher Indices and lower FAZ tomorrow still. I predict FAZ will form a red candle with a long, lower shadow, but may not drop below today's lows.

Thursday, March 12, 2009

Stupid Is As Stupid Does

Had another shot at dumping FAZ at a decent price (high 59.50) in the opening minutes. But again held on to see if it would go higher. Today wasn't that day, and the words, "wealth destruction" keep entering my head. Still confident that the rally will end soon, and will be watching price action closely again tomorrow.

What did we learn today? When that voice in your head tells you to shoot, SHOOT! No more second guessing the guy, at least take SOME profits off the table.

Looking around at long-term sentiment, I'm finding rumors that oil is moving up to a more stable price (which usually moves the markets opposite these days). That's also spurring talk of inflation again, more bear-talk.

As for pics, WTF is going on with Scottrade? According to their chart, FAZ shot up like nuts at the close, but the numbers at the top say it closed at 41.60. Even Yahoo! says it has dropped off even further since the close. I'll have to see what Scottrade's chart looks like after the open tomorrow.

What did we learn today? When that voice in your head tells you to shoot, SHOOT! No more second guessing the guy, at least take SOME profits off the table.

Looking around at long-term sentiment, I'm finding rumors that oil is moving up to a more stable price (which usually moves the markets opposite these days). That's also spurring talk of inflation again, more bear-talk.

As for pics, WTF is going on with Scottrade? According to their chart, FAZ shot up like nuts at the close, but the numbers at the top say it closed at 41.60. Even Yahoo! says it has dropped off even further since the close. I'll have to see what Scottrade's chart looks like after the open tomorrow.

Wednesday, March 11, 2009

Ride the FAZ

During a break at work this morning, I check out Stewie's blog to see what's new. He had just put in a post that states that FAZ and SKF are in good, short-term positions for the upside. I check it out and figure I could tell what he was talking about.

Looking at the 5-day, I see FAZ is bouncing off a lower channel and the overall rally is expected to be short. Price action was showing a swift turnaround from the opening activity, and it looked promising.

I jumped in at 54.69 and watched it rocket up to about 60. I needed it to get to above 64 to make back my losses from Monday, but I was still willing to take what I could off the table. However, I instead hung on to see if it would go higher and had to get back to work. When I got the chance to look back at it, the price had plummeted back down to 55. I watched to price go back up and down two more times, each time considering that I should jump off near 60. But I kept waiting, hoping, actually, for it to cross 60 and shoot up even further.

I watched the prices at the end of the day to see which way they would go. They're moving in the right direction, so I decided to hold overnight. Very, VERY risky with a 3x short ETF! But looking at the long-term charts, and figuring that the bear rally may be over after tomorrow, I figure that the risk is reduced. Aftermarket action climbed up, too. I may be in the money right now, but it could always gap down tomorrow and fall away. Keep the finger on the trigger.

To the experienced day-trader, these are all probably horrific, newbie mistakes. Let me just say that the worse part is not my inexperience, but that I have to limit my trading severely because of my job. With patience and better stops, I expect to find a balance and routine into a part-time trading schedule.

That's also why I have this blog. I don't care if nobody ever reads it, because it will be here for me to look back and study my own mistakes.

Looking at the 5-day, I see FAZ is bouncing off a lower channel and the overall rally is expected to be short. Price action was showing a swift turnaround from the opening activity, and it looked promising.

I jumped in at 54.69 and watched it rocket up to about 60. I needed it to get to above 64 to make back my losses from Monday, but I was still willing to take what I could off the table. However, I instead hung on to see if it would go higher and had to get back to work. When I got the chance to look back at it, the price had plummeted back down to 55. I watched to price go back up and down two more times, each time considering that I should jump off near 60. But I kept waiting, hoping, actually, for it to cross 60 and shoot up even further.

I watched the prices at the end of the day to see which way they would go. They're moving in the right direction, so I decided to hold overnight. Very, VERY risky with a 3x short ETF! But looking at the long-term charts, and figuring that the bear rally may be over after tomorrow, I figure that the risk is reduced. Aftermarket action climbed up, too. I may be in the money right now, but it could always gap down tomorrow and fall away. Keep the finger on the trigger.

To the experienced day-trader, these are all probably horrific, newbie mistakes. Let me just say that the worse part is not my inexperience, but that I have to limit my trading severely because of my job. With patience and better stops, I expect to find a balance and routine into a part-time trading schedule.

That's also why I have this blog. I don't care if nobody ever reads it, because it will be here for me to look back and study my own mistakes.

Tuesday, March 10, 2009

Snap Out of It!

After getting my rear handed to me in some short-term trades, I've remembered to better log my trades. I've mostly stayed away from the markets through all this downturn, and have read about daytraders getting washed out of the Game over the past few months. I'll be watching the S&P as a primary indicator of what's going on in the markets in general. The financials are also volatile, which could be a good place for short-term trades...as soon as I get around to examining them.

The charts seem to tell me that we still have farther to fall, but right now is a time to consolidate.

The charts seem to tell me that we still have farther to fall, but right now is a time to consolidate.

Monday, March 09, 2009

I'm my own Contrarian Indicator

A trader who goes by 'Stewie' is one of the best traders I've met online. I frequent his blog often and recently commented on what I'm doing with my retirement money. It took another guy to help me realize that I might be a contrarian indicator for the full-timers out there. How's that for confidence?

In other news, here's something I put together today to relate to my real job.

I used to read Dilbert in college and wonder if my life would actually end up like that.

In other news, here's something I put together today to relate to my real job.

I used to read Dilbert in college and wonder if my life would actually end up like that.

Sunday, March 08, 2009

We're B-a-a-a-a-a-a-c-k!

Hey, I found my old blog! It will be nice to record my thoughts and musings again, now that I've sold the restaurant and returned to my old ways again. So much has changed since my last entry, but I'm just going to pick up where I left off for now.

The markets are in the middle of a "death spiral", and I'm starting to see signs of blood in the streets. We're certainly not there yet, but I believe the rebound will be just as fierce as the fall. More to come.

The markets are in the middle of a "death spiral", and I'm starting to see signs of blood in the streets. We're certainly not there yet, but I believe the rebound will be just as fierce as the fall. More to come.

Friday, November 03, 2006

Pizza Party

It's official, I have bought my first business. Not just a piece of stock, but the whole thing. Got a great deal on an Italian restaurant in South Daytona, about the price of the equipment. This is what has been distracting me from all the stock research I was doing only months ago, but I'm hoping to find a new routine soon.

I never saw the sudden drop in stocks that I was waiting for in October. However, it seems that things are starting to stall as we approach the election next week. I'm sure there's a pattern usually seen after off-Presidential elections, but I'm not going to play that game this time. I'm starting to like news-less research all over again!

Besides, the blogs are where it's at! Mainstream media is best for the herds (but there is BIG money in it)!

I never saw the sudden drop in stocks that I was waiting for in October. However, it seems that things are starting to stall as we approach the election next week. I'm sure there's a pattern usually seen after off-Presidential elections, but I'm not going to play that game this time. I'm starting to like news-less research all over again!

Besides, the blogs are where it's at! Mainstream media is best for the herds (but there is BIG money in it)!

Sunday, October 29, 2006

Taking it in the Shorts

Whew! Over a month since my last post, and nobody noticed. Oh well, there's been so much going on in my life that I haven't had much time to look at investing, let alone write about it.

Meanwhile, my virtual stock game at VSE is showing my getting ripped a new one from betting agains Google. All I can say for myself is, "ow." I'm keeping the short for now because I'm getting some change back that I lost.

Now I know why some money managers NEVER attempt to short. Not a good idea when the Dow is breaking new highs and the other indices are tagging along!

Cheers! And here's to more posts to come soon!

Meanwhile, my virtual stock game at VSE is showing my getting ripped a new one from betting agains Google. All I can say for myself is, "ow." I'm keeping the short for now because I'm getting some change back that I lost.

Now I know why some money managers NEVER attempt to short. Not a good idea when the Dow is breaking new highs and the other indices are tagging along!

Cheers! And here's to more posts to come soon!

Friday, September 15, 2006

A Lot of Loud Silence

As I peruse throught the various stocks and indices out there, I notice that volume has been gradually decreasing for months and more. It's like more people are either sitting on their bets, pulling out of the markets, or just aren't sure where to go (uncertainty). Sure, a few stocks here and there are moving around, but I sure am noticing a lot of volume trailing away. I suppose whenever the market decides to get moving, it's really gonna move!

Perhaps when the reality of housing hits, ARMs convert, foreclosures go up, cats & dogs start living together, we'll see renewed interest in stocks? Or more running for cover?

Speaking of housing, there's this great comment I read off of my favorite (other) blog, The Big Picture:

"...To complete the global picture, consider this - in one of the condo buildings I surveyed in Pune (near Bombay), the builder told me that 50% of the condos were sold to US investors who used, wait for it, HELOCs in their US properties to buy property in India."

And I thought the lottery was the only tax on stupidity!

Perhaps when the reality of housing hits, ARMs convert, foreclosures go up, cats & dogs start living together, we'll see renewed interest in stocks? Or more running for cover?

Speaking of housing, there's this great comment I read off of my favorite (other) blog, The Big Picture:

"...To complete the global picture, consider this - in one of the condo buildings I surveyed in Pune (near Bombay), the builder told me that 50% of the condos were sold to US investors who used, wait for it, HELOCs in their US properties to buy property in India."

And I thought the lottery was the only tax on stupidity!

Thursday, September 14, 2006

Bond-O

My last post addressed how the news and gossip that I read sound very upbeat and positive about the markets. This is a good sign that the smart money might be ready to take some profits. Correct me if I'm wrong, but this rally/correction to the bear-correction may soon be ready for its own correction.

Some say that the bond market contains the 'adults' of the markets, and bond prices are rising. Isn't that a sign that we might be in for some more bad days in stocks? There are all the reasons, FED Watch, Oil prices, housing, etc.. but the fact remains that bonds are rising.

Even this morning, the local Orlando news had a story of realtors admitting that the soft landing is going to be harder than previously thought. They expect the slump in sales to bottom next summer. But they were wrong about the landing (or just didn't want to admit it), so I take their word with a pinch of salt.

Some say that the bond market contains the 'adults' of the markets, and bond prices are rising. Isn't that a sign that we might be in for some more bad days in stocks? There are all the reasons, FED Watch, Oil prices, housing, etc.. but the fact remains that bonds are rising.

Even this morning, the local Orlando news had a story of realtors admitting that the soft landing is going to be harder than previously thought. They expect the slump in sales to bottom next summer. But they were wrong about the landing (or just didn't want to admit it), so I take their word with a pinch of salt.

Wednesday, September 13, 2006

Been Off Track

It's been a while since my last post. My excuse is that I haven't had much to say the past few days. I've been busy with work and family, and really haven't been able to keep up on the markets.

This has cost me in my trading as well as my blogging. I've been hammered the past few days, losing gains while not keeping on top of them. Tonight I begin to scan the indices, news, and other blogs that I watch for updates and find out what I've missed. Gold has fallen, oil is down, and the markets have been rallying in concert.

It's been 3 days now for the Nasdaq to rally, and it's showing signs of weekness. Since I've been hurt shorting so many times, I hesitate to short now. I was hoping to become more bullish, probably because of this uptrend that we've been in for a few weeks now. Meanwhile, the prophecies of another major correction in October still linger, with a few mentioning it. Now WOULD be a good time for another correction, because no one expects it.

There are several reasons that things are up this week, Options expiring Friday, oil down, consumer confidence rising, VIX down, optimistic FED expectations, and the smart money is pounding the Bears. I expect to see some profit-taking on Friday as the rest of us newbies decide to go long.

As for myself, I'm going take a good, long look at the big picture before I jump back in.

This has cost me in my trading as well as my blogging. I've been hammered the past few days, losing gains while not keeping on top of them. Tonight I begin to scan the indices, news, and other blogs that I watch for updates and find out what I've missed. Gold has fallen, oil is down, and the markets have been rallying in concert.

It's been 3 days now for the Nasdaq to rally, and it's showing signs of weekness. Since I've been hurt shorting so many times, I hesitate to short now. I was hoping to become more bullish, probably because of this uptrend that we've been in for a few weeks now. Meanwhile, the prophecies of another major correction in October still linger, with a few mentioning it. Now WOULD be a good time for another correction, because no one expects it.

There are several reasons that things are up this week, Options expiring Friday, oil down, consumer confidence rising, VIX down, optimistic FED expectations, and the smart money is pounding the Bears. I expect to see some profit-taking on Friday as the rest of us newbies decide to go long.

As for myself, I'm going take a good, long look at the big picture before I jump back in.

Wednesday, September 06, 2006

Long Weekend

Well, the 'adults' are back in the markets, as CNBC put it yesterday. And trading is supposedly back to serious trading, as everything closed way up on Monday.

It's good to see an up-day, but I feel that the recent end-of-summer rally is a bit overbought. In particular, I noticed Ford's chart was showing a weeker slope with possible signs of a turnaround. I shorted yesterday, right before Bill's announcement of his new CEO. The stock is up on the overnight news, but I'm not ready to give up yet. The stop is set, and I expect the price to recover down to the low of a channel, maybe to 7.80, before recovery.

Basically, the good news had already been 'baked in' to Ford's stock. I wanted to go long when I first heard Ford had hired a well-known turnaround manager, but the stock had already rallied. But I watched it rise another 2 bucks while waiting for the rocket fuel to burn out. I don't expect to be short more than a week, as I have good faith in the new CEO. However, it will be a long and slow recovery.

Here's a random question:

Why is it that the really cool/funny commercials these days are by the credit card companies? Namely, the Capital One commercials, and the Citi Identity Theft victims are my favorites today. Until about 5 years ago, the beer commercials were the best. What happened? Did those talented marketers move to companies that serve the credit card companies? Or is this a sign of the times, that money is no longer in beer, but in the financial industry?

It's good to see an up-day, but I feel that the recent end-of-summer rally is a bit overbought. In particular, I noticed Ford's chart was showing a weeker slope with possible signs of a turnaround. I shorted yesterday, right before Bill's announcement of his new CEO. The stock is up on the overnight news, but I'm not ready to give up yet. The stop is set, and I expect the price to recover down to the low of a channel, maybe to 7.80, before recovery.

Basically, the good news had already been 'baked in' to Ford's stock. I wanted to go long when I first heard Ford had hired a well-known turnaround manager, but the stock had already rallied. But I watched it rise another 2 bucks while waiting for the rocket fuel to burn out. I don't expect to be short more than a week, as I have good faith in the new CEO. However, it will be a long and slow recovery.

Here's a random question:

Why is it that the really cool/funny commercials these days are by the credit card companies? Namely, the Capital One commercials, and the Citi Identity Theft victims are my favorites today. Until about 5 years ago, the beer commercials were the best. What happened? Did those talented marketers move to companies that serve the credit card companies? Or is this a sign of the times, that money is no longer in beer, but in the financial industry?

Tuesday, August 29, 2006

It's KATRINA all over again!!! Shut down the State of Florida!!!!

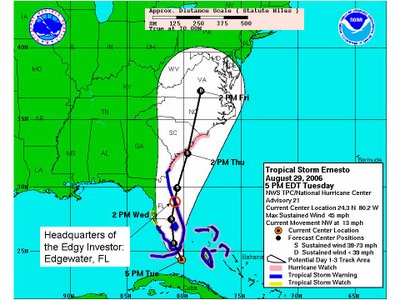

Tropical Storm Ernesto didn't gather enough strength in the waters between Cuba and Miami to attain hurricane strength. Still, a large storm is about to roll over the state and officials have decided to shut it down. The image below states that max sustained winds will be 45 mph, while the evening news is all over Central Florida (where I live) covering those who are stocking up on ice and putting up hurricane shutters.

I shouldn't be too surprised at this irrational exuberance, given today is around the anniversary of Katrina in New Orleans, 500 miles away. I can understand the officials being 'better safe than sorry', but hurricanes and tropical storms lose strength over land. Ernesto will hit Miami rather hard, but not at hurricane strength. It will cruise its way up through the middle of Florida, losing strength the whole time.

I say Orlando and Daytona are over-reacting, closing schools so that the school buses don't have to drive in 'high winds'. We will get rain up here, lots of it dumped down, but not the high winds.

I'll be home with the kids, checking the markets and reading books. Cheers!

I shouldn't be too surprised at this irrational exuberance, given today is around the anniversary of Katrina in New Orleans, 500 miles away. I can understand the officials being 'better safe than sorry', but hurricanes and tropical storms lose strength over land. Ernesto will hit Miami rather hard, but not at hurricane strength. It will cruise its way up through the middle of Florida, losing strength the whole time.

I say Orlando and Daytona are over-reacting, closing schools so that the school buses don't have to drive in 'high winds'. We will get rain up here, lots of it dumped down, but not the high winds.

I'll be home with the kids, checking the markets and reading books. Cheers!

Sunday, August 27, 2006

Running Scared

As I plow through a list of stocks to find opportunities, I couldn't help but notice that many companies (listed under $10) are forming symmetrical triangle patterns. Even more interesting, is that the points of these triangles should appear around Q2 of 2007.

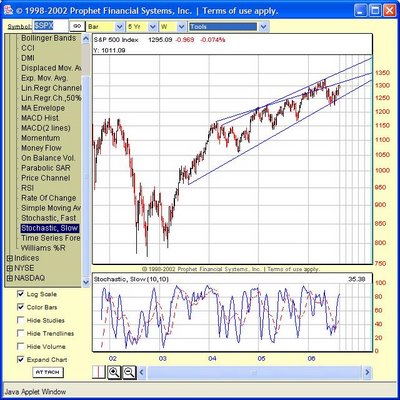

Now, from my limited experience, I've seen breakouts from triangle patterns usually happen before the point is reached. I pulled up a chart of the S&P 500 to get a guess of where it might be in Q1-Q2 of 2007. It's currently riding a channel up, and could be anywhere between 1300 and 1380 if it stays in that channel.

That diagonal line cutting the channel was where I noticed some consolidation on the resistance side. The line follows the upper level from March of 2004 through today, with the exception of the breakout and resistance from Nov 2004 through May 2005. I left that in to note some interesting behavior how that line seems relevant. But this it technical analysis, so it might not mean anything beyond this point. The Stochastics show signs of peaking already, but the momentum and RSI still have room to grow (not shown).

I'm concerned about the weakening Stochastics. I'm dropping my shorts (pun intended) and starting to find myself in more long positions. But I'm afraid this may be too much of running with the Bulls, and the Bears will sneak out from the trees and take us by surprise.

The XAU is nearing resistance, and gold itself is showing weakness at the end of its own symmetrical triangle.

Hmmm....

Now, from my limited experience, I've seen breakouts from triangle patterns usually happen before the point is reached. I pulled up a chart of the S&P 500 to get a guess of where it might be in Q1-Q2 of 2007. It's currently riding a channel up, and could be anywhere between 1300 and 1380 if it stays in that channel.

That diagonal line cutting the channel was where I noticed some consolidation on the resistance side. The line follows the upper level from March of 2004 through today, with the exception of the breakout and resistance from Nov 2004 through May 2005. I left that in to note some interesting behavior how that line seems relevant. But this it technical analysis, so it might not mean anything beyond this point. The Stochastics show signs of peaking already, but the momentum and RSI still have room to grow (not shown).

I'm concerned about the weakening Stochastics. I'm dropping my shorts (pun intended) and starting to find myself in more long positions. But I'm afraid this may be too much of running with the Bulls, and the Bears will sneak out from the trees and take us by surprise.

The XAU is nearing resistance, and gold itself is showing weakness at the end of its own symmetrical triangle.

Hmmm....

Monday, August 21, 2006

Just When I Thought Gas was Getting Better

It's a conspiracy, I tell ya! These oil barons in South America and the Middle East are creating "news" because it keeps oil prices up. The political wing-nuts can say what they will about conflicts, but oil traders are buying up oil futures on any dip. Oil briefly dropped below $70 a barrel Friday, but it didn't last very long. Here's the article:

"VIENNA, Austria (AP) -- Oil prices rose back near $72 a barrel Monday, rebounding from declines the week before, after Iran insisted that it will not suspend uranium enrichment.

Prices also appeared underpinned by concerns about supply disruptions in Nigeria due to civil unrest and fear of potential hurricanes that could strike Gulf of Mexico refineries. Traders were also watching for signals of where fuel demand is headed in the wake of BP's production woes at its Prudhoe Bay field in Alaska...

Speaking after Iran's military test-fired 10 short-range missiles, Foreign Ministry spokesman Hamid Reza Asefi said a nuclear compromise would have to be reached during future negotiations.

"Everything has to come out of negotiations," Asefi said. "Suspension is not on our agenda."

The U.N. Security Council passed a resolution last month calling for Iran to suspend uranium enrichment by Aug. 31 or face the threat of economic and diplomatic sanctions.

"It is very difficult to decide what to do now in this situation," said Koichi Murakami, an analyst with brokerage Daiichi Shohin in Tokyo..."

Enough said.

"VIENNA, Austria (AP) -- Oil prices rose back near $72 a barrel Monday, rebounding from declines the week before, after Iran insisted that it will not suspend uranium enrichment.

Prices also appeared underpinned by concerns about supply disruptions in Nigeria due to civil unrest and fear of potential hurricanes that could strike Gulf of Mexico refineries. Traders were also watching for signals of where fuel demand is headed in the wake of BP's production woes at its Prudhoe Bay field in Alaska...

Speaking after Iran's military test-fired 10 short-range missiles, Foreign Ministry spokesman Hamid Reza Asefi said a nuclear compromise would have to be reached during future negotiations.

"Everything has to come out of negotiations," Asefi said. "Suspension is not on our agenda."

The U.N. Security Council passed a resolution last month calling for Iran to suspend uranium enrichment by Aug. 31 or face the threat of economic and diplomatic sanctions.

"It is very difficult to decide what to do now in this situation," said Koichi Murakami, an analyst with brokerage Daiichi Shohin in Tokyo..."

Enough said.

Wednesday, August 16, 2006

Trampled by the Bulls

Ok, perhaps it's time to finally stop being bearish about the markets. I'm getting run over as I scramble to cover my shorts. The play on XING ripped me a new one today, but I've got a stop set at the last high of $11.57. Too late, I realize I should have set a stop at the new rule of 2%, based on Dr. Alexander Elder's rule for risk control.

While trying to figure out which way it's gonna go tomorrow, I've got a few long candidates, and even a couple of new shorts to watch. This rally is really burning energy at a breakneck pace, so I'm curious what kind of breather it'll take. The build was so strong today that I suspect the S&P 500 will definitely be up again tomorrow. The price and volume look kinda like last year, March 13-20, which went a slightly down, flat, and recovered again. Is the end in sight?

No one ever said anything about the 'blood in the streets' to explain this rally. And where are those people who think we'll have another big drop in the next month or two? Heck, I predicted this rebound was emminent, but I'm still not quick enough to actually recognize it in time. But, yesterday marked the first day I begin printing the charts of my trades upon entry and exit along with notes. Here's to finally showing some improvement!

Think Thursday will be an upday or not?

While trying to figure out which way it's gonna go tomorrow, I've got a few long candidates, and even a couple of new shorts to watch. This rally is really burning energy at a breakneck pace, so I'm curious what kind of breather it'll take. The build was so strong today that I suspect the S&P 500 will definitely be up again tomorrow. The price and volume look kinda like last year, March 13-20, which went a slightly down, flat, and recovered again. Is the end in sight?

No one ever said anything about the 'blood in the streets' to explain this rally. And where are those people who think we'll have another big drop in the next month or two? Heck, I predicted this rebound was emminent, but I'm still not quick enough to actually recognize it in time. But, yesterday marked the first day I begin printing the charts of my trades upon entry and exit along with notes. Here's to finally showing some improvement!

Think Thursday will be an upday or not?

Monday, August 14, 2006